Införandet av en rad europeiska politiska åtgärder för att stödja utvecklingen av den nya energisektorn har inneburit ett starkt statligt stöd till den gröna sektorn i form av politik och finansiering. Varför utvecklar regeringarna energisektorn? Vad innebär den snabba expansionen av energisektorn? Kom och diskutera med författaren.

European PV market accelerates expansion

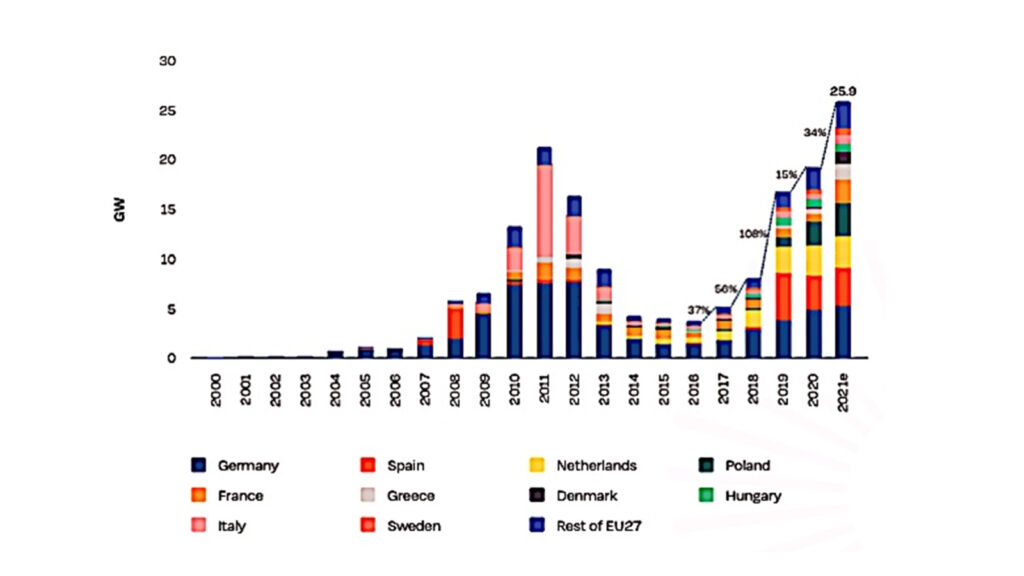

The European market is an important part of the global PV market, and its installed capacity is pivotal in the overall PV market. The rise of European photovoltaic earlier, in 2011 the new installed capacity has reached 23GW, accounting for 74% of the global annual new installed capacity. And then fell into the trough period, after 2018 with the economic recovery, the EU PV market supply and demand on both sides of the rebound.

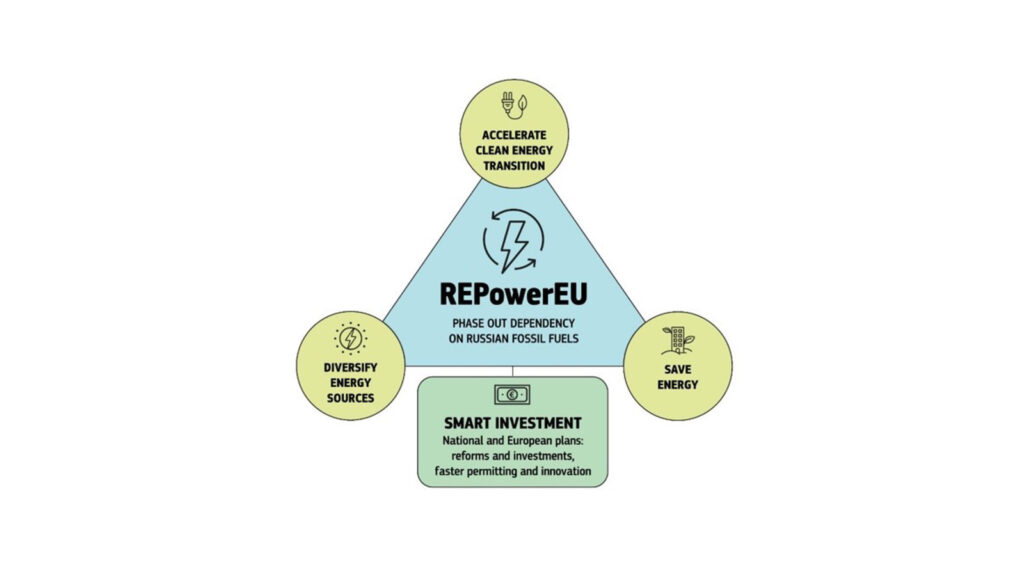

After the Russia-Ukraine conflict, the EU accelerated the process of energy independence. Considering the reality, the first task for European countries if they want to accelerate energy decoupling from Russia is to find alternative energy sources for natural gas. In the REPower EU plan to decouple from natural gas, photovoltaic and wind power together account for about 20% of the total share. It is interesting to note that the requirements for the energy transition in the REPower EU program are to improve energy efficiency, to increase the share of renewable energy sources, and to solve infrastructure bottlenecks in order to reduce dependence on fossil fuels faster at the household, domestic and industrial levels, as well as at the power system level. This can also explain the continuous expansion of the European PV market.

Fiscal expansion influences PV market movements

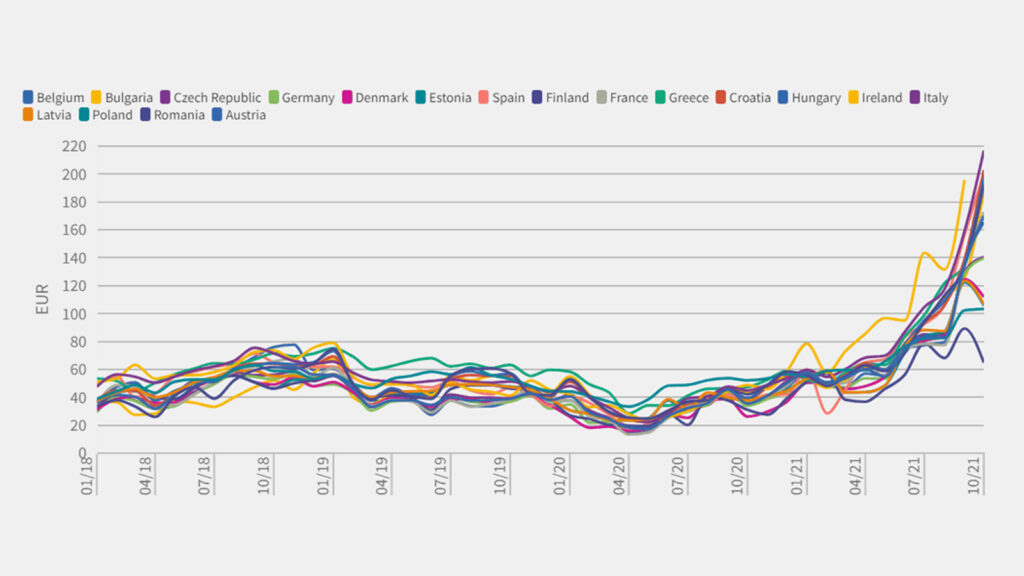

The core element of the expansion of renewable energy, where PV is located, is the fiscal expansion of European government policies. Due to the imbalance of light resources, current PV module prices cannot be achieved to bring European PV to grid parity. The current subsidy mechanism for distributed PV is based on “net metering”, “net pricing” and FiT. And European countries to adopt a variety of subsidies, whether it is the German government’s carbon credit input, Poland’s increasing financial subsidies, the government’s source of funding bucket fish carbon credit revenue-related. The popular carbon border tax in the last two years is also a refraction of the fiscal expansion.

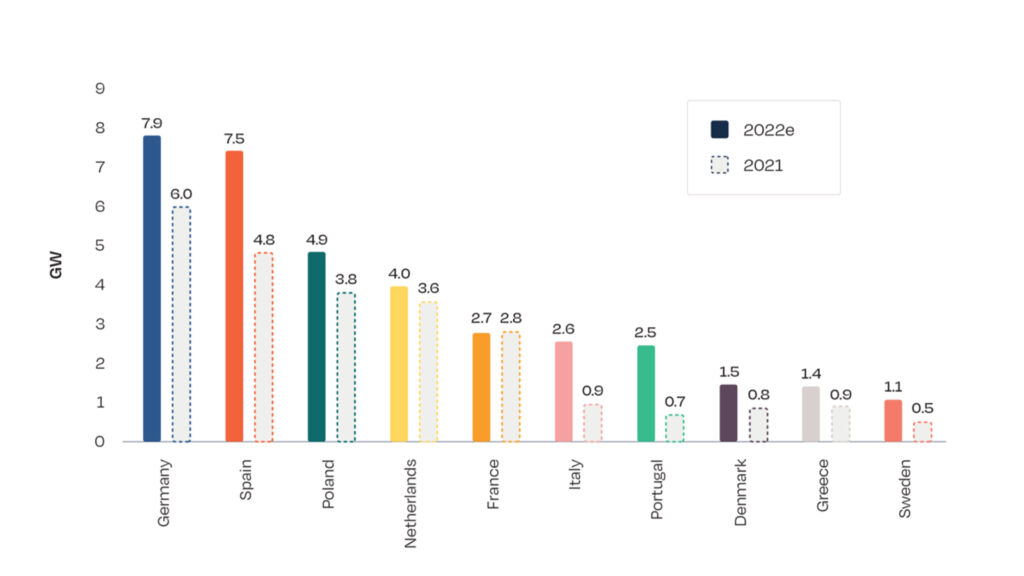

Due to the ground power plant one to two years of the construction cycle this time requirement, the European PV market bidding expansion action will be gradually transmitted to the installed level in this year and next two years. Second, the energy crisis in Europe under the high price of electricity, while the fiscal expansion policy to promote a period of prosperity in the distributed installation. Market-led, bidding and policy-driven will support long-term demand in the European PV market.

The top five countries in terms of cumulative installed capacity in each EU country are: Germany, Italy, Spain, UK, and France. The three drivers of PV development are: self-consumption system, PPA, and auction. European countries take different responses according to their local light conditions and the current status of PV development. Germany abolished the FiT surcharge in the last year. Most provinces and regions in Spain have abolished building permits after UNEF’s advocacy. The Netherlands has adopted the SDE++ program for commercial rooftop and ground-mounted plants. Meanwhile, net metering programs and micro-generation units are working well in Poland. And France has expanded its FiT after the S12 decree.

Maysun Solar, a professional PV module manufacturer with 15 years of experience, offers a wide range of PV modules to meet different needs. They are suitable for various scenarios such as balcony PV, rooftop, ground power station, etc. Welcome to click the button for more information.