Last week, the European Commission introduced the Net Zero Industry Act to expand the scale of clean technology manufacturing in the EU and to ensure that the EU is well prepared for the clean energy transition. This article is intended to discuss with readers whether the proposed bill has an impact on the photovoltaic industry.

Draft Net-Zero Industry Bill Issued

Together with proposals for a European Key Raw Materials Bill and electricity market design reforms, the Net-Zero Industry Bill sets out a clear European framework to reduce the EU’s reliance on highly concentrated imports. By drawing on lessons learned from the energy crisis triggered by the Covid-19 coronavirus sweeping the world and the Russian invasion of Ukraine, it will help improve the resilience of Europe’s clean energy supply chain to help the EU achieve its clean energy transition goals.

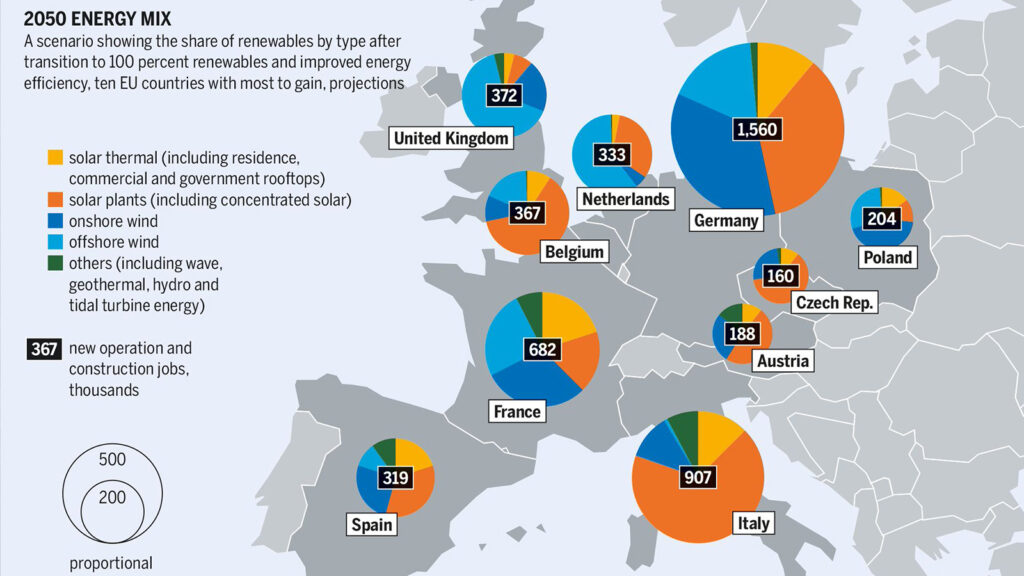

The proposed legislation includes a range of best-in-class fuels and technologies such as solar PV and solar thermal, onshore wind and offshore renewables, batteries and storage, heat pumps and geothermal energy, fuel cells, carbon capture, utilization and storage, and grid technologies. The relevant technologies identified in the legislation would be subject to strategic support and a 40 percent domestic production benchmark.

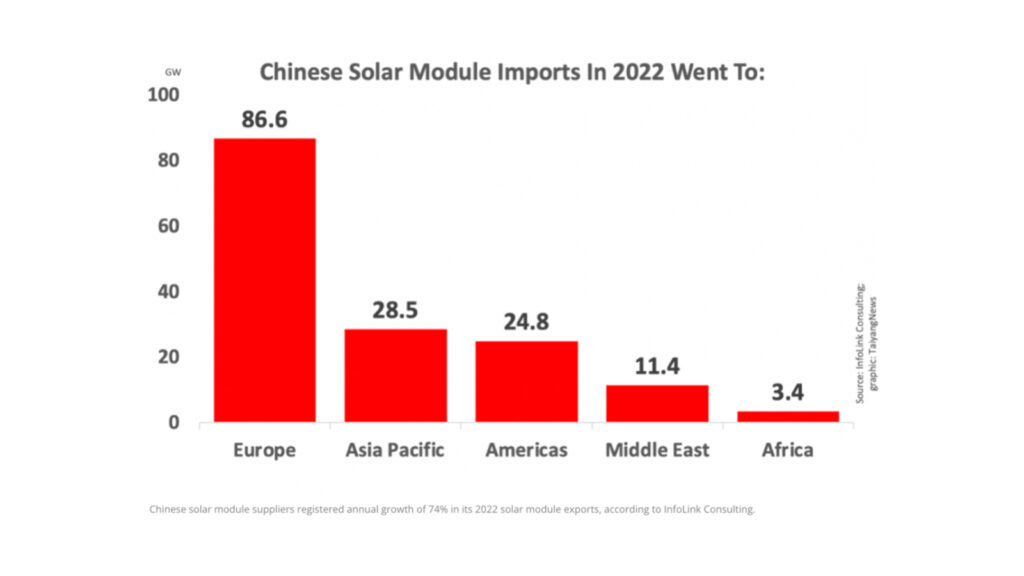

Following the release of this proposal, most believe that it presents a new challenge to Chinese PV exporters who use Europe as their primary export market. In recent years, the European market has been dependent on PV imports from China. From the data of 2022, the European market is highly dependent on Chinese PV products instead of decreasing.

PV manufacturing cost reduction?

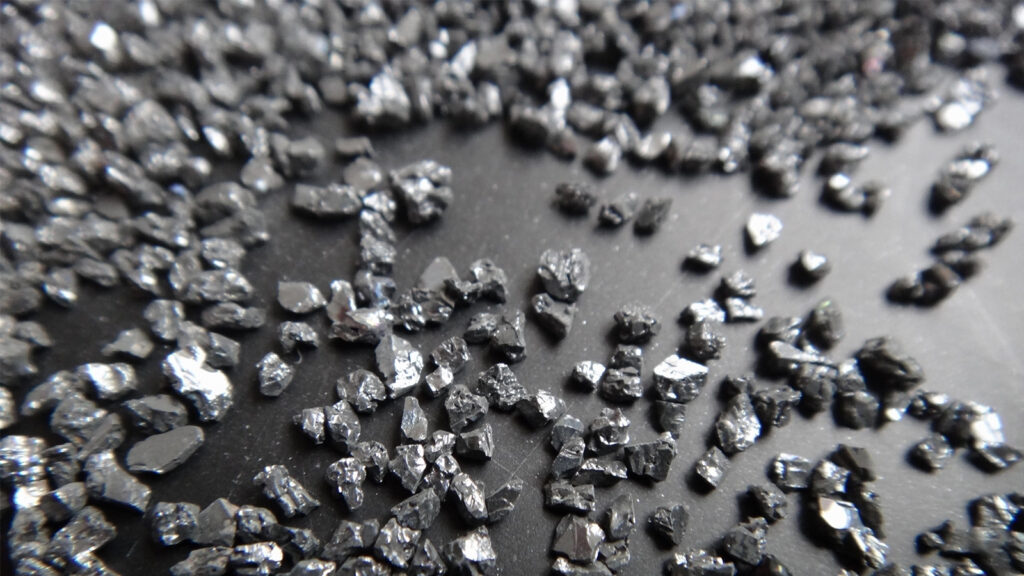

According to the bill, European countries plan to expand the capital investment in photovoltaic manufacturing, despite the high overall cost of manpower, raw materials, energy, the environment, but the EU government insisted on a very clear attitude. Photovoltaic industry is both upstream of the energy industry and manufacturing. The main raw material for solar PV modules is silicon, i.e. high purity quartz sand. But the manufacturing refining process of high-purity quartz sand is difficult, high technical secrecy, in a scarce state. At present, only three companies in the world have the ability to independently manufacture high-purity quartz sand in bulk. They are Unimin (Sibelco), Norway TQC, and China Quartz.

The result of the oversupply of silicon for photovoltaic products is a shortage of high-purity quartz sand and an increase in its market price. The enactment of the Net Zero Act on the European PV manufacturing drive, changes in the demand side will create some risk to the future price of silicon.

The latest chalcogenide technology for the third type of cells, although the raw materials and cost prices are cheaper than silicon cells, but in terms of the number of patents applied for, Japan, the United States, China, South Korea and Germany are in the top five worldwide. In addition, Oxford PV in the UK is the leader in technology development and commercialization. China is the number one producer of calcium-titanium oxide batteries. Therefore, the EU does not have a significant technological and cost advantage in this area.

(To learn more about chalcogenide, please follow or subscribe to Maysun Solar’s account/channel and we will bring you more interesting articles and videos.)

Market changes, Chinese manufacturing advantage is no longer?

The current manufacturing pattern of the photovoltaic industry, China’s market share in which the fierce battle leader. According to statistics, in 2022, China’s total exports of silicon wafers, cells, modules and other products exceeded three consecutive “tens of billions” of dollars, reaching $51.25 billion, compared to $28.4 billion in 2021, a jump of more than 80%. The main purpose of this bill is to get rid of the high dependence of some clean industries on imports and strengthen the EU’s clean energy manufacturing capacity. This will have a certain impact on China’s PV industry exports, but this impact is delayed and will still take some time to be released. Here a conservative estimate of the period of time in a few years later. At the same time it is also echoed in the EU REPowerEU plan “2030 PV cumulative installed capacity of 600GW” target.

It is worth noting that the 40% production benchmark is not more accurate than the specific GW figure target, the bill also lacks corresponding specific measures, the EU still relies on concentrated imports in the field of PV modules, China is still the largest provider of solar PV modules in the EU. To sum up, the market pattern of PV manufacturing will not change much in the short and medium term. The cost advantage of Chinese manufacturing is still strong, and friends in Europe can still work steadily with Chinese manufacturers.

As a PV module manufacturer with 15 years of experience in the industry, Maysun Solar has offices and warehouses in many countries and has established long-term relationships with many excellent installers. You are welcome to contact us to get the latest module quotation or to ask PV related questions.