Contents

Germany: ZEREZ Registration Mandatory for All PV Systems Starting February 1st

Starting February 1, 2024, all photovoltaic systems in Germany must be registered in the Central Register for Units and Component Certificates (ZEREZ) to connect to the grid. This includes inverters and, for larger installations, additional components of the energy systems. The new rule aims to streamline the verification process for grid operators.

The ZEREZ, which became mandatory with an update to the “Regulation on Proof of Electrotechnical Properties of Energy Systems” (NELEV) in May 2024, will manage all necessary certificates for PV systems and other renewable energy installations. It requires all certificates to be submitted by accredited certification bodies or manufacturers, and these are verified by a second party under the “four-eyes” principle.

As of February, operators must provide their ZEREZ ID number to grid operators, who will no longer be allowed to request certificate details outside the register. Failure to register required certificates will prevent a system from being connected to the grid.

Although the ZEREZ system went live in April 2024, market coverage is still developing, with only 827 certificates registered as of January 2025. The industry is working on improving user experience and ensuring full compliance ahead of the February deadline.

Italy Enhances Incentives for EU-Manufactured Solar Modules

Italy has bolstered its incentives for photovoltaic (PV) projects utilizing solar modules produced within the European Union, as part of its Transizione 5.0 Tax Credit initiative. This program is designed to promote the adoption of renewable energy in industrial processes.

Under the updated scheme, fiscal credits now cover up to 35% of the cost of eligible solar modules. These credits are allocated through tenders for projects employing EU-manufactured modules. The tax credit calculation base has been increased, offering:

- 140% for cells achieving a minimum efficiency of 23.5% (up from 120%), and

- 150% for modules incorporating bifacial silicon heterojunction or tandem cells with at least 24% efficiency (up from 140%).

Additionally, modules with an efficiency of 21.5% or higher now qualify for a 130% fiscal incentive.

The revised rules streamline investment brackets, consolidating them into two categories: projects with costs up to €10 million ($10.2 million) and those ranging from €10 million to €50 million. However, the updated policy has removed the additional tax credits (20% to 25%) previously awarded to projects employing EU-made modules that achieved energy consumption reductions of 6% to 15%.

The new provisions also allow the tax credits to be combined with incentives for investments in southern Italy’s Special Economic Zones and Simplified Logistics Zones, as well as other EU subsidies, provided there is no overlap in cost coverage.

These changes are expected to further drive demand for high-efficiency, EU-produced solar modules, fostering the growth of renewable energy projects across Italy.

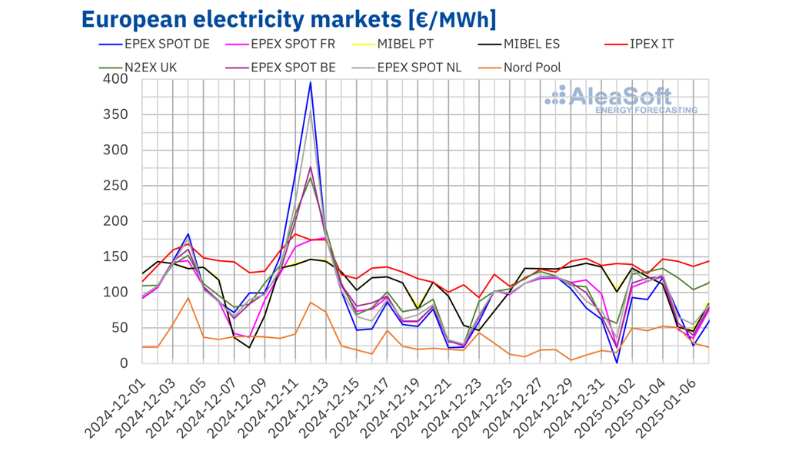

Higher Gas Prices Push European Electricity Costs Upward in Some Markets

AleaSoft Energy Forecasting reported that TTF gas futures reached their highest settlement price since October 2023 in early January 2025, driving up electricity prices in several major European markets.

In the first week of January, electricity prices rose in the Italian, Nordic, Portuguese, and Spanish markets, while they fell in Belgium, the UK, the Netherlands, France, and Germany.

Weekly average electricity prices exceeded €85 ($87.59)/MWh in most analyzed markets, except for the Nordic and German markets. The Nordic market had the lowest average price at €34.96/MWh, while the Italian market recorded the highest at €140.39/MWh.

The rise in electricity prices in certain markets was attributed to TTF gas futures reaching a weekly settlement price of €50.20/MWh on January 2—the highest since October 2023. However, high wind energy production in France and Germany led to price decreases in these markets.

Looking ahead, AleaSoft predicts that most European markets will see rising electricity prices in the second week of January. Conversely, prices in Italy, Portugal, and Spain are expected to decline due to anticipated increases in wind energy production.

In terms of solar energy, the first week of January saw reduced production across France, Germany, Italy, Portugal, and Spain. AleaSoft forecasts a rebound in solar output in Germany during the second week, while declines are expected to persist in Italy and Spain.

Hungary Approves Solar Measures for Apartment Buildings

Hungary has approved new measures to simplify solar panel installation on apartment buildings. Starting July 1, 2025, only solar plants with grid-connected inverters will be allowed.

The new rules, finalized in December 2024, enable apartment owners to form energy communities within their buildings. Two or more owners can now agree in writing to jointly install rooftop solar systems, sharing both the costs and benefits of the system.

Through the Napenergia Plusz Program, the government has been promoting rooftop solar adoption, offering grants for residential solar and storage installations. With a budget of HUF 75.8 billion ($204.8 million), this initiative is expected to drive the installation of over 300,000 solar systems by the end of 2024.

Additionally, from July 2025, all new solar plants must have grid-connected inverters to provide better data for managing energy supply and demand. Existing systems will need to submit production data from July 2025, while projects with older inverters will only need to provide their inverter IDs.

The number of household solar plants in Hungary has more than doubled since early 2022, and the country aims to increase its renewable energy share from 14% to 25% by 2030.

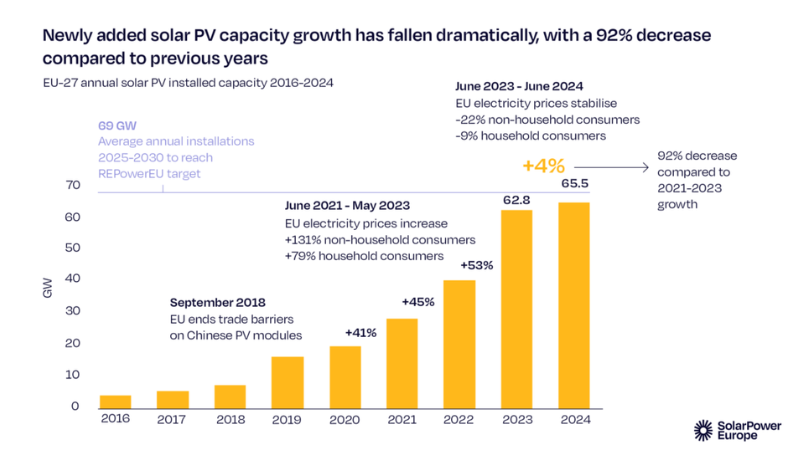

SolarPower Europe: European Solar Market Growth Slows Dramatically – 65.5 GW Expected in 2024

The European photovoltaic (PV) market is expected to add 65.5 gigawatts (GW) of solar capacity in 2024, marking just a 4% increase from 2023. This is the smallest growth in years, with annual investments also declining due to falling PV component prices.

The European solar market had been growing rapidly, with increases of 40% or more in recent years, but this growth appears to have slowed. SolarPower Europe reports a new record of 65.6 GW for 2024, but this is only a 4% increase from last year’s 62.8 GW. Overall, the EU now has about 338 GW of installed solar power.

In 2024, only five of the EU’s top 10 solar markets saw growth, including Germany, Italy, France, Greece, and Portugal. Germany remains the largest market with 16.1 GW expected, followed by Spain (9.3 GW), Italy (6.4 GW), and France (4.7 GW). However, Poland and the Netherlands have seen a decline in installations.

A major factor behind the slowdown is weaker demand for residential rooftop systems, as the pressure on households to invest in solar has decreased since the gas crisis. SolarPower Europe expects the ground-mounted PV sector to grow faster than rooftop installations in the second half of the decade.

The cost of solar systems has dropped by an average of 28% in 2024, mainly due to lower component prices and reduced project lead times, which also affected investments. The total investment in solar is expected to fall for the first time this decade, from €63 billion in 2023 to €55 billion in 2024.

Walburga Hemetsberger, CEO of SolarPower Europe, warned that slower solar expansion could hinder Europe’s energy security, competitiveness, and climate goals. To meet its 2030 target, Europe needs to install around 70 GW annually, and corrective measures must be taken now to avoid falling short.

The association also stressed the need for increased flexibility in the energy system, including a 16-fold increase in battery storage capacity by 2030, to improve solar power’s economics and reduce energy prices.

Looking ahead, SolarPower Europe’s projections for 2024-2028 are less optimistic, with growth rates expected to slow to between 3-7% annually. By 2030, the EU could have a total of 816 GW of installed solar, about 8% lower than previous forecasts. In the worst-case scenario, Europe might miss its REPowerEU goal and only reach around 650 GW.

Since 2008, Maysun Solar has been dedicated to producing high-quality photovoltaic modules. Our range of solar panels, including IBC, HJT, TOPCon panels, and balcony solar stations, are manufactured using advanced technology and offer excellent performance and guaranteed quality. Maysun Solar has successfully established offices and warehouses in many countries and built long-term partnerships with top installers! For the latest quotes on solar panels or any photovoltaic-related inquiries, please contact us. We are committed to serving you, and our products provide reliable assurance.

Reference:

Siemer, J. (2025, January 3). ZEREZ-Eintrag ab 1. Februar für alle Photovoltaik-Anlagen verbindlich. Pv Magazine Deutschland. https://www.pv-magazine.de/2025/01/03/zerez-eintrag-ab-1-februar-fuer-alle-photovoltaik-anlagen-verbindlich/

Jowett, P. (2025, January 6). Hungary approves measures for solar on apartment buildings. Pv Magazine International. https://www.pv-magazine.com/2025/01/06/hungary-approves-measures-for-solar-on-apartment-buildings/

Enkhardt, S. (2024, December 17). Solarpower Europe: Wachstum des europäischen Photovoltaik-Marktes verlangsamt sich dramatisch – 65,5 Gigawatt Zubau für 2024 erwartet. Pv Magazine Deutschland. https://www.pv-magazine.de/2024/12/17/solarpower-europe-wachstum-des-europaeischen-photovoltaik-marktes-verlangsamt-sich-dramatisch-655-gigawatt-zubau-fuer-2024-erwartet/

Tripodo, M. (2025, January 10). Italy increases incentives for EU-made solar modules. Pv Magazine International. https://www.pv-magazine.com/2025/01/10/italy-increases-incentives-for-eu-made-solar-modules/

Jowett, P. (2025, January 10). Higher gas prices drive some European electricity prices upwards. Pv Magazine International. https://www.pv-magazine.com/2025/01/10/higher-gas-prices-drive-some-european-electricity-prices-upwards/

Empowering Factories with Solar Energy A Strategic Tool for Controlling Production Electricity Costs

Commercial and industrial solar is becoming a key solution for factories to reduce electricity costs and hedge against price fluctuations. This article systematically analyzes its deployment models, cost advantages, and sustainable value pathways.

How Businesses Can Offset Carbon Taxes with Solar Power

This article analyzes the latest carbon tax policies and photovoltaic deduction strategies, helping European businesses legally reduce taxes, increase profits through solar investment, and achieve a win-win situation for both economy and environment.

Forecast and Response: Seizing the Next Decade’s Growth Dividend in Europe’s Commercial and Industrial Photovoltaics Market

Maysun Solar analyzes the growth trends of commercial and industrial photovoltaics in Europe over the next ten years, from policies and ESG to technological innovation, helping companies seize the initiative in the energy transition.

How to Calculate Solar System ROI and Optimize Long-Term Returns?

Solar power is becoming a key solution for businesses to reduce costs and improve efficiency. Accurately calculating ROI and optimizing long-term returns are essential to maximizing investment value.

Will Agrivoltaics Affect Crop Growth?

Agrivoltaics combines solar energy and agriculture to reduce up to 700 tons of CO₂ per MW, improve water use, and boost crop growth for sustainable farming.

6.5 Billion Loss Hits Photovoltaics: Reshaping or Elimination?

In 2025, the photovoltaic market may see a turnaround as some companies take early action. A €6.5 billion loss is driving businesses to explore new growth areas like energy storage and hydrogen. Which giants will break through? Industry transformation is accelerating!

We are truly grateful for your encouragement, which means so much to us and our efforts.

Thank you for your encouragement! It means a lot to us. If there’s anything specific you’d like to learn or discuss, feel free to share your thoughts!