Intro:

In the ever-changing technological environment, many changes are bound to take place in the photovoltaic energy sector. The impact of international current events on the PV industry, as well as modifications to the PV market and new European regulations, will be presented in this article.

Table of Contents

A Mind-Blowing Innovation: Foldable Photovoltaic Pallets

Pallets, once an ordinary product, have become extraordinary with the infusion of “photovoltaics.”

In the revolutionary evolution of photovoltaic component packaging, we recently learned that the US-based PV Pallet Company has introduced a foldable and recyclable photovoltaic component pallet.

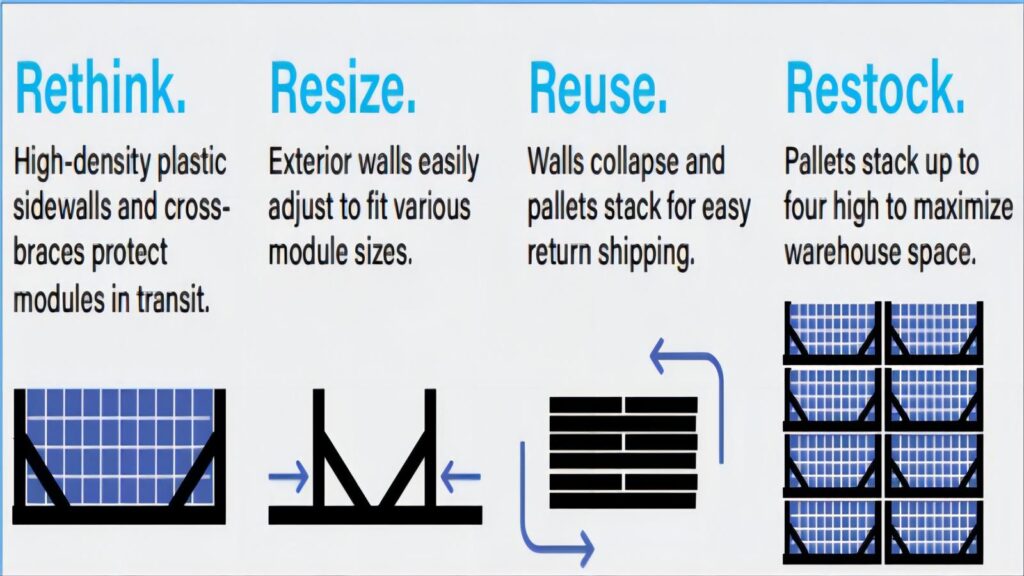

The advantages of PV Pallet’s solar photovoltaic component transportation solution include:

High-density plastic sidewalls and crossbars to protect components from impacts during transportation.

Adjustable sidewall spacing to accommodate various component sizes easily.

Foldable sidewalls allow for stacking multiple pallets, making them suitable for recycling transportation.

Pallets can be stacked up to four layers, maximizing warehouse space utilization.

PV Pallets come at a considerable cost, emphasizing their recyclability. Despite the initial higher investment compared to traditional wooden pallets, their long-term benefits are evident.

The use of pallets for photovoltaic components started with conventional pallets, and with the advancement of component technology, two major revolutionary breakthroughs have occurred in the past.

The first revolution occurred in 2015 with the rise of double-glass components. When double-glass components were initially introduced to the market, the design led to a high rate of breakage during transportation. Innovatively, Hongchun Group designed partitions for protection within the pallet, significantly improving the transportation efficiency of double-glass components. Hongchun also introduced the concept of recyclable metal pallets, which had a significant impact on the green recycling of the entire photovoltaic industry chain.

This design was widely adopted in the industry for double-glass components, and even as double-glass components evolved to have smaller frames, some design principles continued to be used.

The second revolution in photovoltaic component pallets occurred in the past year, driven by the introduction of extra-large components. The transportation of extra-large components became a critical aspect of the 182 vs. 210 competition. Both sides in this heated debate proposed innovations in pallet design, pushing the limits of efficiency to minimize redundancy between containers and pallets. Nevertheless, both sides failed to completely depart from the traditional model of component packaging, which included wooden pallets and sturdy cardboard outer casings.

The evolution of photovoltaic component packaging is a direct result of the technological revolution within the industry.

New ESG Standards in Solar: A Shift in Global Photovoltaic Supply?

In October 2023, the solar industry witnessed a significant shift with the introduction of the SSI ESG standards. Touted as the world’s premier comprehensive Environmental, Social, and Corporate Governance (ESG) standards tailored specifically for the solar value chain, these standards encapsulate sustainability requirements across various production components. This includes multicrystalline silicon, silicon ingots, wafers, cells, modules, and other manufacturing facilities. Additionally, the standards have pioneered a “one-stop service” for independent verification of ESG commitments at production sites.

At their core, the SSI ESG standards emphasize three pillars: governance and business ethics, environmental stewardship, and labor rights.

The European Union’s roll-out of ESG regulations, particularly the CSRD (Corporate Sustainability Reporting Directive), has sent ripples across the global business landscape. Encompassing over 50,000 companies both within and beyond EU borders, the CSRD has expanded the roster of businesses mandated to meet ESG reporting requirements. With reporting costs potentially ranging from €30,000 to €100,000, there’s a burgeoning market potential in this domain. Moreover, the CSRD aims to elevate the caliber of ESG disclosures, bolstering the appeal of global ESG investments. In essence, any entity collaborating with European firms—including product and service providers—will find themselves navigating the CSRD’s compliance landscape. Notably, leading Chinese photovoltaic giants like JinkoSolar, Longi Green Energy, and JA Solar are encompassed within the CSRD’s purview.

For businesses aspiring to flourish in the European domain, compliance with these newly minted ESG standards is non-negotiable. Prompt and transparent ESG disclosures along the supply chain are paramount, ensuring due diligence is met in this evolving regulatory environment.

Solar Module Shipment Rankings for the First Three Quarters of 2023 Released!

Recently, Sobi PV unveiled the rankings for solar module shipments for the first three quarters of 2023. The data reveals that JinkoSolar leads the pack with over 52GW in shipments during this period. LONGi Green Energy and Trina Solar closely follow, both tied for the second spot with shipments ranging between 45-46GW. JA Tech secured the fourth position with shipments between 38-39GW.

From 2022, throughout the first half of 2023, and extending into the first three quarters of 2023, JinkoSolar, JAO Technology, LONGi Green Energy, and Trina Solar have consistently held their positions in the global Top 4 for solar module shipments. The fifth spot is occupied by the longstanding solar module giant, Atlas, which reported shipments of 22.8-23GW in the first three quarters of 2023.

There have been three notable shifts in the solar module shipment rankings for the first three quarters of 2023:

With the integration of TOPCon technology, JinkoSolar is poised to clinch the title of the top solar module shipper for 2023, positioning itself as the global leader.

AT&S’s hold on the fifth position in module shipments appears to be waning, with both Tongwei and Chint making significant strides. The competition for the spots from Top 5 to Top 9 in global module shipments is intensifying.

Traditional manufacturers like Ring Sheng PV, Yingli Energy, and TengHui PV have been edged out of the top rankings. The competition for positions between Top 10 and Top 20 is heating up.

Based on the data, the cumulative shipments from the Top 10 manufacturers in the first three quarters of 2023 range from a minimum of 282.6GW to a maximum of 286.8GW.

Business Photovoltaics Flourishing in Spain and Germany

In a recent insightful interview with “Photovoltaic” magazine, Gaëtan Masson, the esteemed Chief Executive Officer of the Becquerel Institute and the Operational Agent for the Photovoltaic Power Systems Program of the International Energy Agency (IEA PVPS), shed light on the burgeoning commercial photovoltaic sector in key European markets. Masson highlighted the lucrative opportunities that commercial photovoltaics present, with investors reaping significant profits.

Delving into the realm of utility-scale photovoltaic power generation, Masson delineated three primary business models. The first, bidding, is marked by its low-risk profile. The second, power purchase agreements (PPAs), carries a moderately higher risk, particularly in the realm of commercial PPAs, which hinge on private companies and may be subject to unforeseen events over the course of the 20-year agreement. The third and potentially most rewarding yet risk-laden option is commercial photovoltaics. Masson underscored that, given the prospects of commercial photovoltaics in Germany and Spain, coupled with the elevated prices in the wholesale markets, the potential for substantial profits significantly outweighs the associated risks, positioning it as a prime investment opportunity.

Masson pointed out that this trend is gaining traction in specific European markets, with Spain and Germany at the forefront. He also noted the emergence of this trend in Italy, albeit at a slower pace, owing to the country’s fluctuating solar energy regulations.

To illustrate, in Spain’s southern region, market prices range from 50 to 100 euros per megawatt-hour. In contrast, the levelized cost of electricity (NCOE) for photovoltaics stands at approximately 20 euros (equivalent to around $21.17) per megawatt-hour, rendering it an exceptionally attractive investment proposition.

Reference:

Segal, M. and Segal, M. (2023) EU Council adopts new European Green Bond Standard.

Commercial photovoltaics continues to grow in Spain and Germany

https://www.kesolar.com/headline/244416.html

Brainstorm! Foldable photovoltaic tray

https://solar.ofweek.com/2021-08/ART-260008-8220-30517077.html

Photovoltaic Daily Daily, everyone can read about the photovoltaic world!

https://mp.weixin.qq.com/s/bDUAuI6vG4Yomuwm0zWceA

How to Effectively Clean and Intelligently Maintain Photovoltaic Systems for Optimal Performance?

Explore how scientific cleaning and intelligent maintenance can ensure the efficient operation of commercial and industrial photovoltaic systems. Practical advice covers module cleaning frequency, monitoring system configuration, and long-term strategies for energy savings and performance enhancement.

2025 European Photovoltaic Policy Map: Deployment Paths and Regional Strategies for Commercial and Industrial Photovoltaics

A comprehensive analysis of the 2025 European commercial and industrial photovoltaic policy map, focusing on deployment strategies, incentive comparisons, and zero-investment models to support businesses in achieving an efficient and green transition.

Empowering Factories with Solar Energy A Strategic Tool for Controlling Production Electricity Costs

Commercial and industrial solar is becoming a key solution for factories to reduce electricity costs and hedge against price fluctuations. This article systematically analyzes its deployment models, cost advantages, and sustainable value pathways.

How Businesses Can Offset Carbon Taxes with Solar Power

This article analyzes the latest carbon tax policies and photovoltaic deduction strategies, helping European businesses legally reduce taxes, increase profits through solar investment, and achieve a win-win situation for both economy and environment.

Forecast and Response: Seizing the Next Decade’s Growth Dividend in Europe’s Commercial and Industrial Photovoltaics Market

Maysun Solar analyzes the growth trends of commercial and industrial photovoltaics in Europe over the next ten years, from policies and ESG to technological innovation, helping companies seize the initiative in the energy transition.

How to Calculate Solar System ROI and Optimize Long-Term Returns?

Solar power is becoming a key solution for businesses to reduce costs and improve efficiency. Accurately calculating ROI and optimizing long-term returns are essential to maximizing investment value.