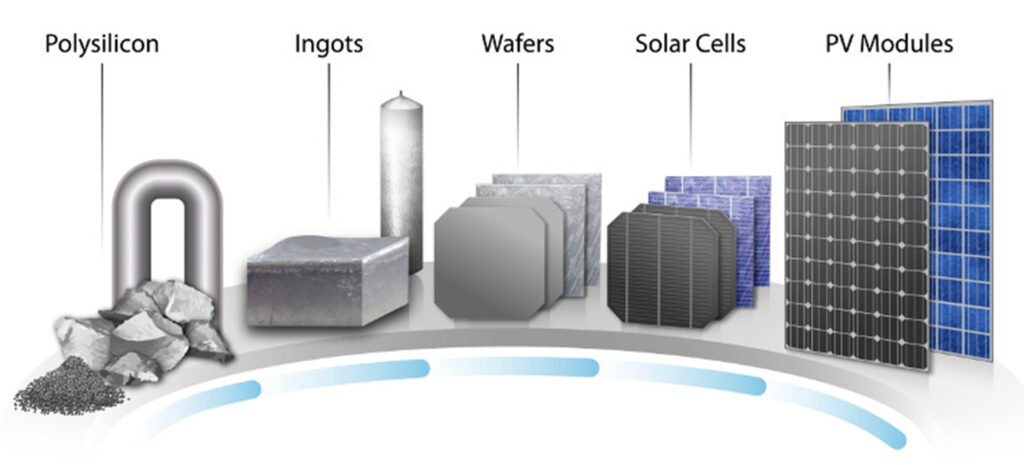

Recently, two giant silicon wafer companies, Longi Green Energy and TCL Zhonghuan, took the lead in cutting prices! The upstream of the PV industry chain cut prices, so that the downstream seems to see the inflection point. PVinfolink quotes a polysilicon drop of up to nearly $1, by this influence, in its offer silicon wafers, cells, modules have a certain rate of reduction.

Silicon materials: first drop in the last two years, prices go down

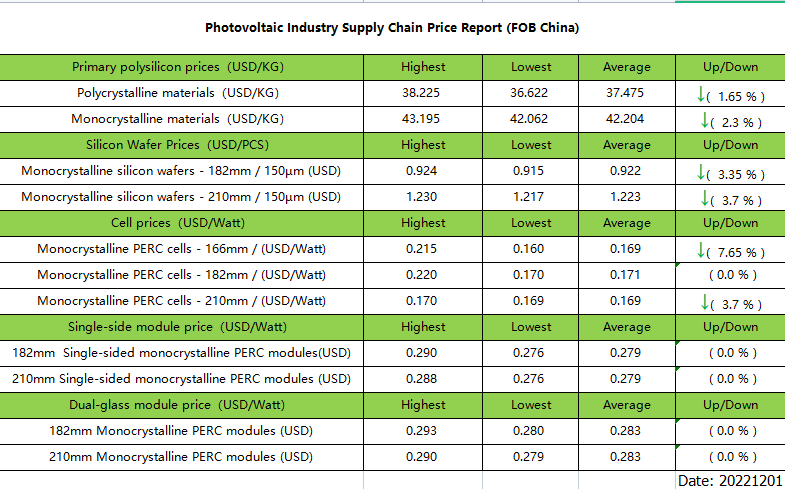

Silicon prices finally fell slightly this week, with the mainstream transaction price for polysilicon at US$42.912/KG and for monocrystalline dense material at US$42.201/KG, a drop of about 1.65%-2.3% from last week. Near the end of the month, the market began to negotiate December silicon orders, the recent wafer prices continue to fall, silicon enterprises in the bargaining pressure increased, this week has been signed silicon order transaction prices have declined significantly. Although the mainstream first-line manufacturers are expected to start negotiating and signing orders from next week, there are still more orders being executed this week, but the second-line factory price range continues to expand, hoping for a drop in the atmosphere has reached its peak. At present, silicon prices have reached a sensitive period, each company’s judgment of the market and different strategies, it is difficult to predict the subsequent silicon wafer price trend.

Silicon wafers: huge production capacity, prices continue to fall

Wafer prices continued to fall this week, with M10 mainstream transaction prices at US$0.922/chip and G12 mainstream transaction prices at US$1.223/chip, down gradually to 3.35%-3.7%. According to the current financial reports of listed companies and research, at the end of 2022, silicon wafer production capacity will exceed 677GW. but according to CPIA statistics in the first half of the year, polysilicon production should be in tight balance, silicon wafer production in the first half of the year 152.8GW, it can be seen that 677GW of silicon wafer production capacity is undoubtedly the most excess link, price reduction is an inevitable trend. Compared with the last round of prices, TCL Central this price cut of up to 4.6%, while the previous Longi Green’s new round of silicon wafer price cut of up to 1.6%. At present, silicon is the bottleneck of the photovoltaic manufacturing industry, along with the release of silicon production capacity to drive prices down, the short-term oversupply situation will continue, silicon wafer prices still have room to fall.

solar Cells: price declining, demand Decreasing

As a result of the mismatch between supply and demand in the industry chain caused by differences in battery technology routes, prices have loosened slightly, and it is relatively difficult to deal with high prices, making it a downward market in which specialized enterprises have begun to wait and see. This week, the mainstream transaction price of monocrystalline M6 cells is about $ 0.169 / W, down 7.65%; M10 cells mainstream transaction price is flat; G12 cells mainstream transaction price is about $ 0.169 / W, down at 1.17%. Short-term still need to pay attention to the downstream start-up situation, if the component enterprises cut the start-up rate, the battery side of the situation of supply shortage or will change.

solar modules: adjustment of silicon material and wafer prices, component prices remain stable

The execution price of the forward order is maintained at 0.272-0.277 USD/W, and the current implementation of the previous order is the main focus. With the recent price cuts in the upper reaches of the industry chain, component prices may fall, further stimulating terminal installed demand, but currently affected by geopolitics, labor and other factors, installed demand has cooled. n-type components, stabilized this week, the market mainstream offer at $0.306-0.312 / W. With the silicon wafer silicon prices down, downstream demand is expected to increase, which is conducive to downstream performance up The market was stable this week, with mainstream quotes in the range of US$0.306-0.312/W.

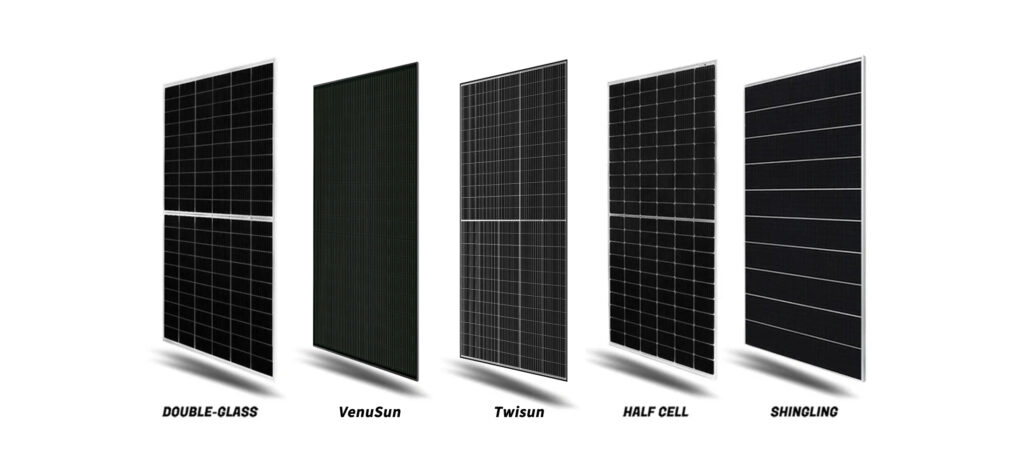

Maysun solar has been specialising in the manufacture of high quality PV modules since its inception in 2008, please contact us for more information on our products.