Table of Contents

European PV Subsidy Policies

EU proposes policies to accelerate the realisation of REPowerEU’s objectives

The European Union proposed two draft policies in March this year in order to accelerate the achievement of REPowerEU’s target of 45% of Europe’s total installed capacity from renewable energy sources by 2030 (approx. 1,236 GW) and a total of 600 GW of new photovoltaic (PV) installations. The Net Zero Industry Act and the Critical Raw Materials Act will be implemented within the context of the EU’s earlier-released Green Deal Industrial Plan.

The Green New Deal Industry Plan, which is backed by multiple measures, is considered as a strong response to the US Inflation Reduction Act, which was passed last year. The Inflation Reduction Act is expected to invest $369 billion over ten years in the renewable energy industry, including additional subsidies and tax breaks for photovoltaics, wind power, energy storage, and other areas, while the EU is also discussing progress toward expanding investment and subsidies.

In addition to the EU-led policy, a number of European countries have recently updated their renewable energy targets for 2030, such as Italy, which announced that the PV installed target increased from 52 GW to 79.9 GW, an increase of about 53%, and Spain, which increased from 39 GW to 76 GW, an increase of a staggering 94%, and long as the European photovoltaic town of Germany, which increased from 200 GW to 76 GW, an increase of an amazing 94%, The installed target ranges from 200 to 215 GW.

New subsidy policy in Germany from 26 September

From 26 September 2023, you can submit a new application for funding under the “Solar for Electric Vehicles (442)” scheme, which provides grants of up to €10,200 for the purchase and connection of charging stations, photovoltaic systems and solar energy storage systems!

The grant is intended for owner-occupiers of residential buildings with electric vehicles for the purchase and connection of charging stations, photovoltaic systems and solar energy storage systems!

The subsidised measures include:

The purchase of a new charging station (e.g. wallbox) with a minimum charging capacity of 11 kilowatts (kW)

The purchase of a new photovoltaic system with at least 5 kilowatt peak (kWp) power output

The purchase of a new solar energy storage unit with a storage capacity of at least 5 kilowatt hours (kWh).

The installation and connection of the entire system, including all installation work.

An energy management system to control the entire system

Requirements for the subsidy:

You create the charging station, photovoltaic system and solar electricity storage system brand-new.

You have not yet ordered any of these components at the time of application.

You own an electric car (not a hybrid vehicle) that is registered to you or a person living in your household, or you have ordered an electric car at the time of application.

Note: If you lease the electric car privately, the lease contract must have a term of at least 12 months. A company or company car does not meet the eligibility requirements.

Your residential building already exists and you already live in it.

Grant amount and payment:

The grant is made up of the following partial amounts:

1.For the charging station: 600 euros lump sum – or 1,200 euros lump sum in the case of bidirectional charging capability

2.For the photovoltaic system: 600 euros per kWp, maximum 6,000 euros

3.For the solar power storage unit: 250 euros per kWh, maximum 3,000 euros

You can receive a maximum grant of 10,200 euros for your project. We will pay the grant directly into your account.

If the total costs of your project fall below the grant amount, you cannot receive any funding.

It is not possible to combine the grant with other funding such as loans, allowances and grants.

For more information, please click on this website:https://www.kfw.de/inlandsfoerderung/Privatpersonen/Bestehende-Immobilie/F%C3%B6rderprodukte/Solarstrom-f%C3%BCr-Elektroautos-(442)/

New subsidy policy in France in 2023

Bonus for installing solar panels increased in 2023.

In addition to its financial and environmental benefits, solar energy has become more accessible to private individuals thanks to falling installation costs. According to Greenpeace, the average price of a residential solar system has fallen from 12,000 euros in 2010 to around 7,500 euros in 2022.

What’s more, French people wishing to install solar panels can take advantage of a range of attractive financial incentives. One of these is the Energy Transition Tax Credit (CITE). Under this scheme, part of the cost of installing solar panels can be deducted from income tax, reducing the total cost of the investment. In addition to the CITE, there are local grants, such as those from the Agence Nationale de l’Habitat (ANAH), which provide financial support for energy renovation projects, including the installation of solar panels.

The government can also pay a self-consumption bonus. This is available subject to certain conditions, and ranges from €110 to €500 per kWp depending on the size of the photovoltaic installation. Prime Minister Elisabeth Borne promised last September that the scheme would be extended to 2023. Households installing photovoltaic panels in 2023 will be eligible for a premium of €1,290 for a 3 kWp installation, and €1,920 for a 6 kWp installation. Individuals can also benefit from a zero-rate eco-loan (PTZ). This can be used to finance part of their solar project. The amount can range from €7,000 to €30,000.

New subsidy policy in Italy in 2023

In 2023 there are two types of incentives for the installation of photovoltaic panels.

The first is the IRPEF deduction 50% of the expenses incurred for the purchase and installation of the PV system.

The second is the 90% superbonus (in 2023 the rate is reduced from 110% to 90%) for photovoltaic systems and storage batteries, which are, however, trailed interventions. From 2023, access is also restricted on the basis of household income, which must be below 15,000 euro, and is only allowed for dwellings used as first homes.

The incentives stipulated that anyone producing electricity by installing a photovoltaic system that harnesses the sun’s energy, and thus produces energy from a renewable and non-polluting source, could access state funding for the remuneration of the kilowatt hours (KWh) produced at a price above the market price, for a period of twenty years.

In this way, those who have installed a system with photovoltaic panels and produce electricity for their own consumption (or even a surplus), will no longer have to pay electricity bills to the energy distribution company (subject to fixed costs per year of a few dozen euros). In fact, for a period of twenty years, it will collect a contribution (called ‘state financial incentive’) directly proportional to the amount of energy produced.

The extra energy produced by a grid-connected photovoltaic system is then sold to the energy distribution company.

New subsidy policy in Sweden in 2023

As of 1 January 2021, a new subsidy for solar cells, a so-called green deduction applied. The solar cell grant is given in the form of a tax deduction of 20% (previously 15%) of material and labour costs. You can receive a maximum of SEK 50 000 per person per year from the new investment subsidy for solar panels.

In order to apply the green tax deduction to a turnkey contract, a standard rate for material and labour costs is used. According to the standard, 97 per cent of the total cost is counted as material and labour costs. The green tax deduction is therefore 19.4 per cent of the total cost of solar cells (0.2*0.97 = 0.194).

NOTE! The green tax deduction for solar cells was increased from 15% to 20% on 1 January 2023.

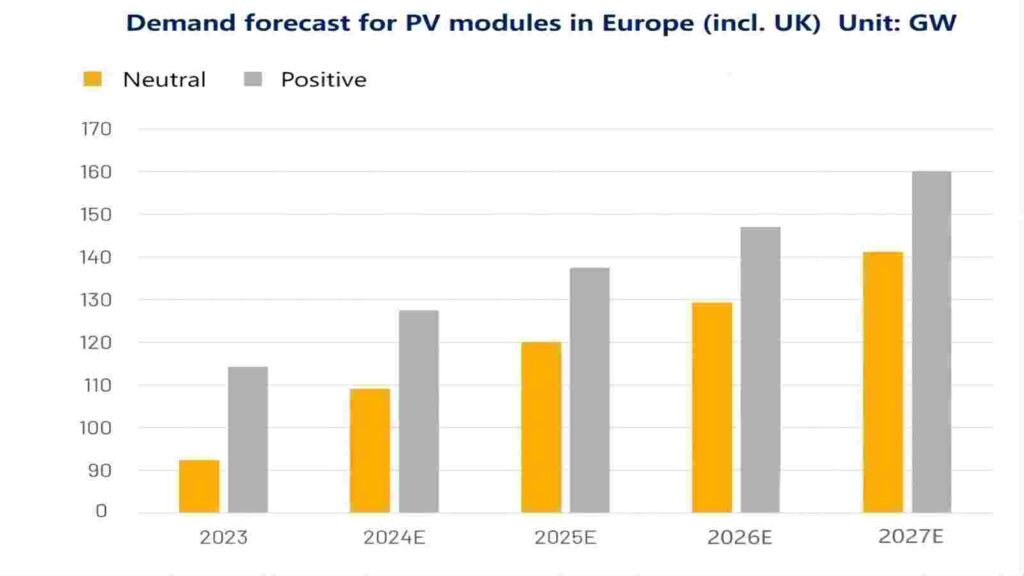

To summarize, policy development in European countries will enhance PV market terminal demand. According to InfoLink, PV module demand in the European market (including the UK) ranged between 92 and 114 GW in 2023. Although the short term is hampered by issues such as excess inventory and delayed grid connection progress due to a lack of work, it is expected that in the long run, in line with favorable policies and the optimization of supply chain technologies and costs, module demand in the European market will reach 141-160 GW by 2027, with an annualised compound growth rate (CAGR) of about 7%-8.9%, indicating that the European PV market’s growth potential is still present.

PV Price Trends

PV cell prices under pressure to fall, PV glass prices ushered in a rebound.

PV Cell

This week’s mainstream transaction price of PV cells in China continued to fall slowly, M10 cell mainstream transaction price of 0.73 yuan (0.095 euros) / W, G12 cell mainstream transaction price of 0.72 yuan (0.094 euros) / W, M10 monocrystalline TOPCon battery people’s price of 0.78 yuan (0.10 euros) / W.

From the supply side, the cell link still maintains full production, and the overall supply is more adequate; from the demand side, the module cost pressure transfer to the cell link, with part of the specialized module enterprises maintaining production cuts and reduced procurement demand for batteries; part of the battery enterprise forced to ship pressure, low price to keep a single, but the PV module enterprise price pressure mentality is strong, and it is expected that in the short term.

From the supply side, PV module start mainly by the first-line factory support, part of the specialised PV module enterprises continue to reduce production to the upstream pressure; from the demand side, the terminal demand increment is still less than expected, the PV module market competition is fierce, the integration module enterprises continue to maintain the low price advantage, specialised module enterprises intend to raise, but the price rise support is insufficient, is expected that in the short term the PV module price is still mainly to remain stable.

In Chinese market, auxiliary materials, this week, glass prices rose sharply, 3.2mm thickness of glass mainstream price of 28 yuan (3.61 euros) / ㎡, 2.0mm thickness of glass mainstream price of 20 yuan (2.58 euros) / ㎡, respectively, rose 7.69%, 11.11%. Recently, the photovoltaic glass no new capacity to put, the market turnover situation is still good, but the price of soda ash remains high, glass companies are forced by cost pressures, the trend of upward adjustment.

PV Industry News

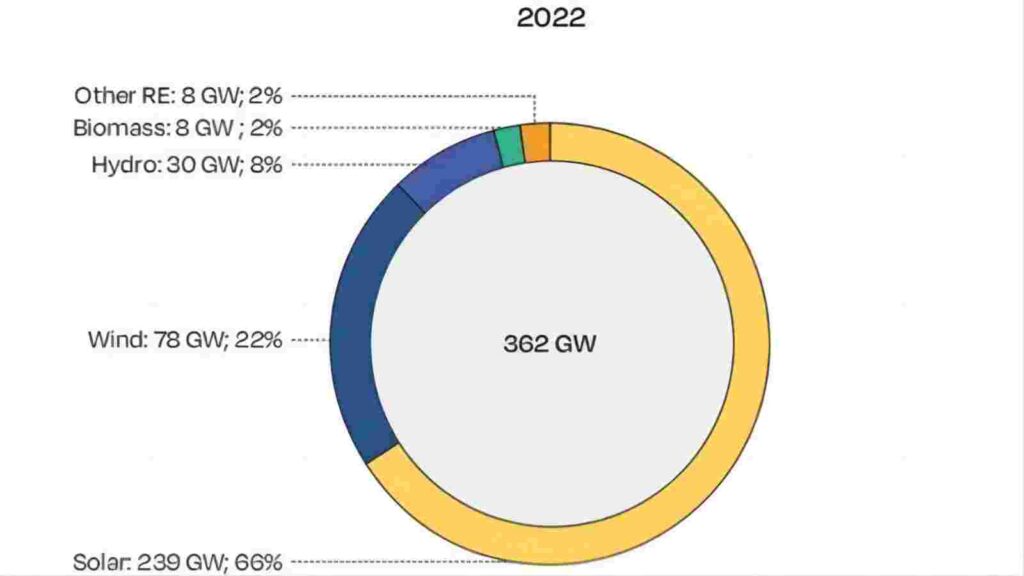

In 2022, 239GW of new PV capacity was installed globally, up 45% from 165GW in 2021.

The 2023-2027 Global PV Market Outlook was updated by SolarPower Europe on June 13 local time at the Intersolar Europe solar photovoltaic exhibition in Munich, Germany.

Data from SolarPower Europe’s research indicates that in 2022, there was 239GW of new PV installed capacity worldwide, a 45% increase from the previous year. According to the research, 2023 is predicted to be another “boom year” for PV, with 341GW of new PV capacity expected to be built during the year, representing a year-over-year growth rate of almost 43%.

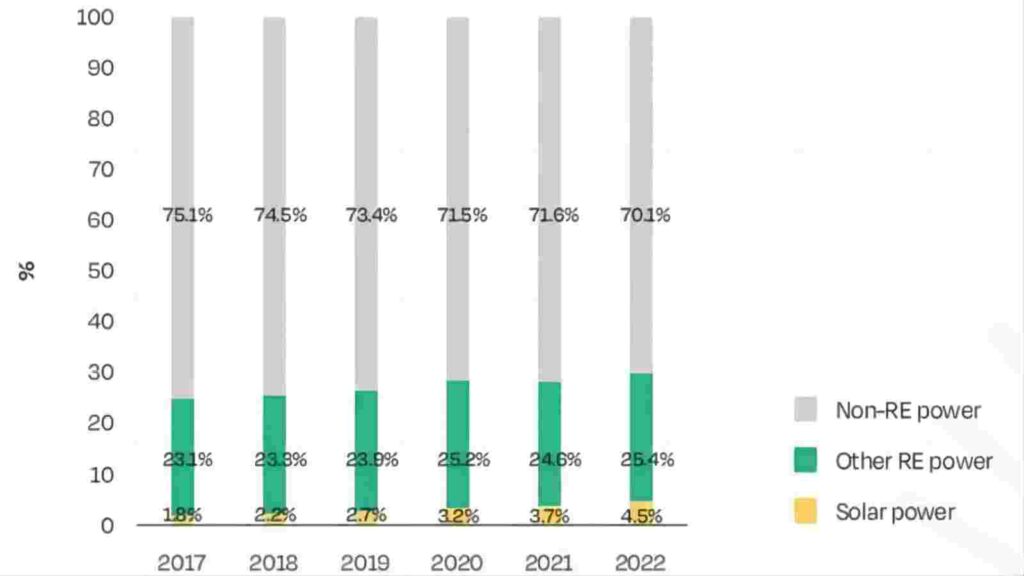

Photovoltaic continues to lead the field of renewable energy generation

The global renewable energy power generation capacity has been increasing in recent years due to the global energy crisis and support from national policies. 362GW of new installed renewable energy power production capacity was available globally in 2022, an increase of 18% over the previous year. An extra 239 GW of solar installed capacity made up 66% of this total, which is nearly twice as much as the installed capacity of all other renewable energy sources, such as wind, hydro, and biomass power generation.

However, when compared to the overall amount of electricity produced worldwide in 2022, PV represents just 4.5% of that total. Despite having a tiny percentage, PV has been steadily increasing for many years in a row, reaching 3.2% in 2020, 3.7% in 2021, and 4.5% in 2022, all at a faster rate than other renewable energy sources.

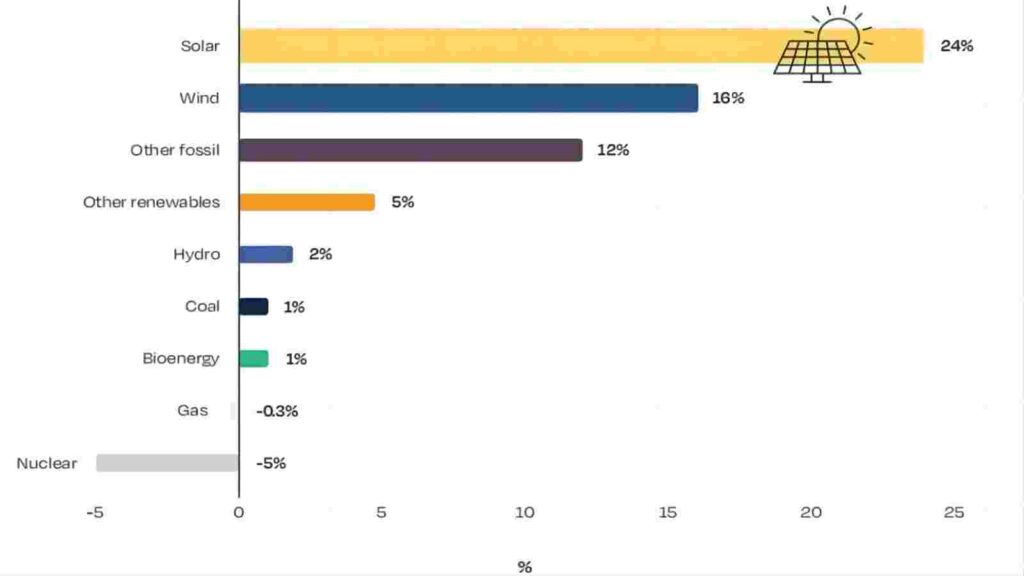

When comparing the growth rates of the various power production technologies, solar comes out on top with a growth rate of 24%, followed by wind in second place with a growth rate of 16% during the past year. 10% came from other fossil fuels, 5% from other renewables, 2% from hydropower, 1% from coal, and 1% from biomass.

Natural gas growth rates decreased by 0.3%, while nuclear power growth rates dropped by 5%.

PV Famous Company News

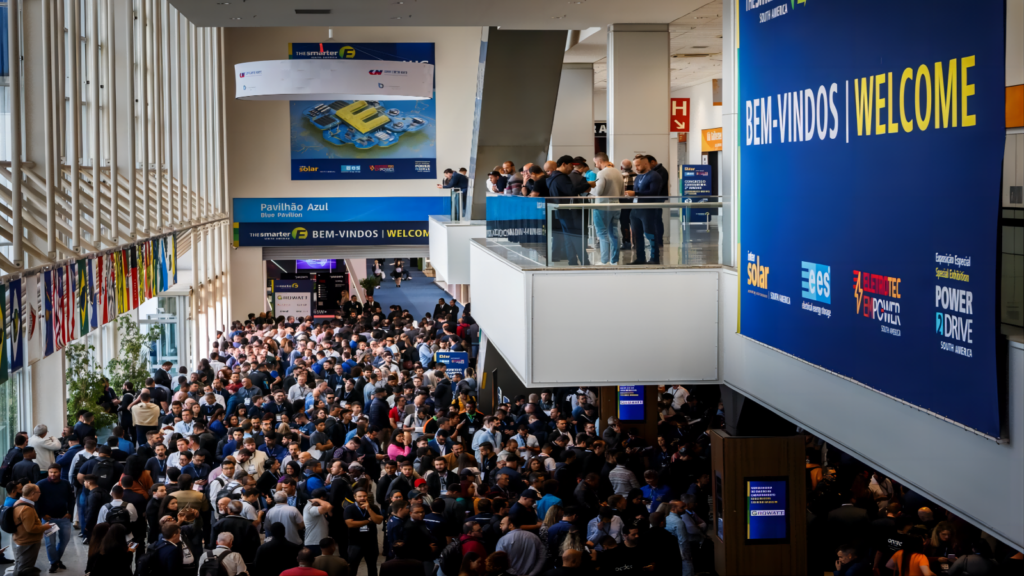

Intersolar South America: Leading companies gather at 210R, nearly 80% of exhibitors’ module power breaks 600W, N-type exhibits occupy the mainstream.

According to preliminary statistics, there are 68 global PV module exhibitors at this exhibition, with 53 manufacturers exhibiting 600W+ modules accounting for 78% of the total, and nearly 80% of the modules using 210 or 210R batteries; the power of 20 companies’ module products has exceeded 700W, and all have adopted 210 battery stacked N-type technology.

Recently, dozens of worldwide top PV module manufacturers (including:JinkoSolar, Trina Solar, JAO Technology, LONGi Green Energy, Atlas, Dongfang Risheng, Wuxi Suntech, Tongwei, Chint New Energy, and so on) made a spectacular debut with a number of star exploding PV module products at Intersolar South America, South America’s largest and most prominent international solar energy show. Among them, the 600W+ ultra-high-power module sparked the entire scene once more, becoming the industry’s wind vane.

As the “Pilot” of the PV era, Trina Solar has led the industry into the 600W+ era with its advanced, open, and compatible 210 product technology platform; through deep investment in customer value, Trina Solar has innovatively launched 210R rectangular wafer modules and significantly promoted the unification of module sizes; and Trina Solar has taken the lead in realizing the 600W+ module era through the combination of 210 and N-Type TOPCon technology. Trina Solar has taken the lead in mass manufacturing of N-type TOPCon 700W+ modules using 210 and N-type TOPCon technology, ushering the industry into the 700W+ age of PV. Trina Solar will continue to lead the PV industry into a new age of high-quality development in the future.

The market has recognized the value of large-size PV goods, with product penetration continuing to climb and manufacturing capacity scale increasing dramatically, changing the pattern of industry development. According to Tibco Consulting, large-size module capacity will reach 767GW in 2023, accounting for over 90% of the market; 210 module capacity reaches 508GW, accounting for nearly 60%.

Maysun Solar has been specialising in producing high quality photovoltaic modules since 2008. Choose from our wide variety of full black, black frame, silver, and glass-glass solar panels that utilise half-cut, MBB, IBC, and Shingled technologies. These panels offer superior performance and stylish designs that seamlessly blend in with any building. Maysun Solar successfully established offices, warehouses, and long-term relationships with excellent installers in numerous countries! Please contact us for the latest module quotations or any PV-related inquiries. We are excited to assist you.

Reference:

Global PV exceeds expectations! SolarPower Europe releases latest report – hxny. (n.d.). https://hxny.com/nd-90828-0-24.html

European Policy and PV Market Outlook – Polaris Solar PV. (n.d.). (n.d.). https://guangfu.bjx.com.cn/news/20230905/1330119.shtml

Cell Prices Under Pressure, PV Glass Prices Rebound (2023.9.14)-North Star Solar Photovoltaic. (n.d.). https://guangfu.bjx.com.cn/news/20230914/1331992.shtml

Intersolar South America: Leading companies gather at 210R, nearly 80% of exhibitors’ module power breaks 600W, N-type exhibits occupy the mainstream – OFweek Solar PV Net. (n.d.). (n.d.). https://solar.ofweek.com/2023-09/ART-260006-8130-30610555.html

Incentivi Fotovoltaico 2023: Contributi, Detrazioni, Agevolazioni Fiscali, Conto Energia. (n.d.). Incentivi Fotovoltaico. https://www.incentivifotovoltaico.name/

Stefania. (2023). Incentivi fotovoltaico residenziale 2023: dai bonus al reddito energetico. Rinnovabili.it. https://www.rinnovabili.it/energia/fotovoltaico/incentivi-fotovoltaico-residenziale-2023/

Sebastien, J. (2023, August 28). Quelles aides pour financer vos panneaux solaires en 2023 ? Hello Watt. https://www.hellowatt.fr/panneaux-solaires-photovoltaiques/aide-installation-panneaux-solaires

Aide panneau solaire et photovoltaïque en 2023 : la liste. (n.d.). https://www.lamaisonsaintgobain.fr/guides-travaux/renovation-energetique-habitat-durable/aide-panneau-solaire-et-photovoltaique-les-8-subventions-pour-2023

Deb, C. (2023, June 8). Les aides à l’installation de panneaux solaires augmentent en 2023. Natura Sciences. https://www.natura-sciences.com/s-adapter/laides-panneaux-solaires-augmentent-2023.html

How to Effectively Clean and Intelligently Maintain Photovoltaic Systems for Optimal Performance?

Explore how scientific cleaning and intelligent maintenance can ensure the efficient operation of commercial and industrial photovoltaic systems. Practical advice covers module cleaning frequency, monitoring system configuration, and long-term strategies for energy savings and performance enhancement.

2025 European Photovoltaic Policy Map: Deployment Paths and Regional Strategies for Commercial and Industrial Photovoltaics

A comprehensive analysis of the 2025 European commercial and industrial photovoltaic policy map, focusing on deployment strategies, incentive comparisons, and zero-investment models to support businesses in achieving an efficient and green transition.

Empowering Factories with Solar Energy A Strategic Tool for Controlling Production Electricity Costs

Commercial and industrial solar is becoming a key solution for factories to reduce electricity costs and hedge against price fluctuations. This article systematically analyzes its deployment models, cost advantages, and sustainable value pathways.

How Businesses Can Offset Carbon Taxes with Solar Power

This article analyzes the latest carbon tax policies and photovoltaic deduction strategies, helping European businesses legally reduce taxes, increase profits through solar investment, and achieve a win-win situation for both economy and environment.

Forecast and Response: Seizing the Next Decade’s Growth Dividend in Europe’s Commercial and Industrial Photovoltaics Market

Maysun Solar analyzes the growth trends of commercial and industrial photovoltaics in Europe over the next ten years, from policies and ESG to technological innovation, helping companies seize the initiative in the energy transition.

How to Calculate Solar System ROI and Optimize Long-Term Returns?

Solar power is becoming a key solution for businesses to reduce costs and improve efficiency. Accurately calculating ROI and optimizing long-term returns are essential to maximizing investment value.