Table of Contents

Why is commercial and industrial photovoltaics receiving so much attention now?

Europe’s energy landscape is undergoing a profound transformation.

From the gradual implementation of the Carbon Border Adjustment Mechanism (CBAM), to persistently high energy prices, to pressures from ESG disclosures and green financing, European commercial and industrial enterprises are facing unprecedented energy and compliance challenges. At the same time, distributed energy sources such as photovoltaics, with their inherent advantages of “low-carbon, self-consumption, and cost reduction,” are rapidly becoming a key pathway for companies to achieve both energy independence and carbon emission reduction goals.

Against this backdrop, commercial and industrial rooftop PV is entering a strategic window — not only can it effectively reduce operational costs, but it also enables companies to gain a first-mover advantage in green branding and policy benefits. This article, starting from Maysun Solar’s perspective, will analyze in depth the five major growth drivers of commercial and industrial photovoltaics in Europe over the next decade, based on policy trends, technological advances, national differences, and enterprise deployment strategies. It will also offer practical advice to help companies seize the dividends of this energy transition.

commercial and industrial photovoltaics, formally known as “commercial and industrial distributed photovoltaic power generation,” refers to PV systems installed on the rooftops of non-residential buildings such as factories, office buildings, shopping malls, and logistics centers. Their installed capacity typically ranges from 30 kW to several MW, operating under a core model of “self-consumption with surplus electricity fed into the grid.” Compared to residential PV and ground-mounted power stations, commercial and industrial photovoltaics is closer to the load side, offering shorter payback periods and more flexible financial models, thereby effectively improving energy efficiency and cost structures for businesses. More importantly, C&I users are both energy consumers and producers, and they naturally possess significant unused rooftop space that has long been overlooked under traditional energy models — a potential that is now rapidly being activated.

So, in the coming decade, what forces will accelerate the development of commercial and industrial photovoltaics in Europe? What kind of growth trajectory will it follow?

What is the current state of commercial and industrial photovoltaics development in Europe?

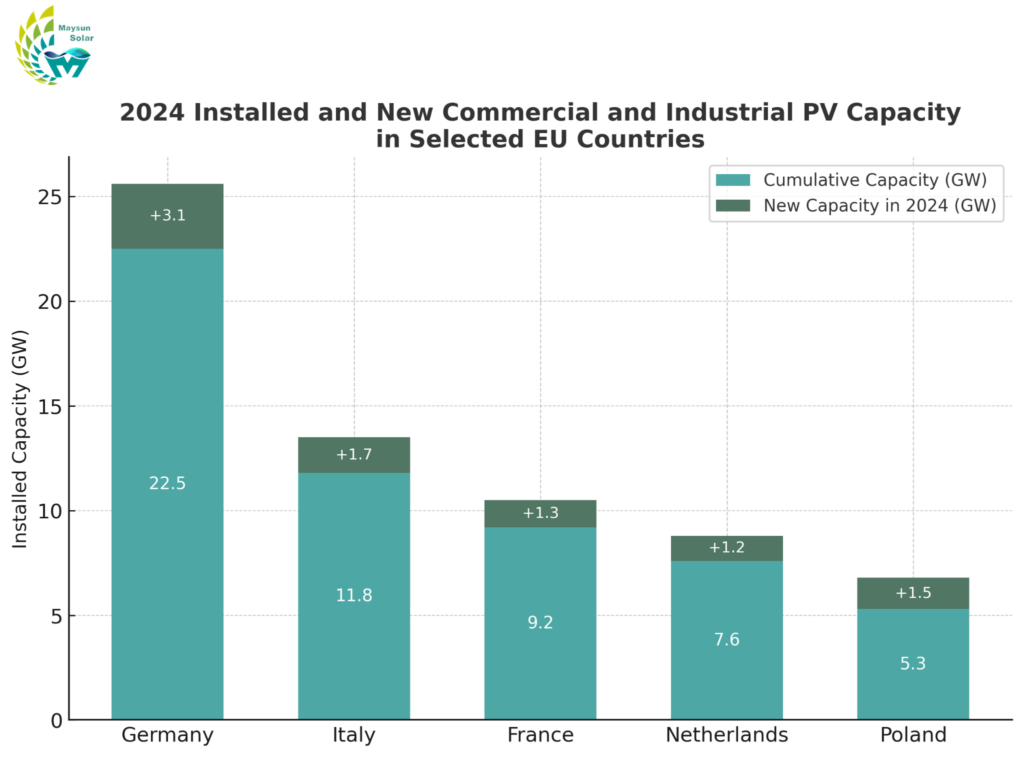

As a unified energy market, the EU’s member states may not be fully synchronized in their development of commercial and industrial photovoltaics, but the overall trend is nearly identical: commercial and industrial photovoltaics is becoming the core driver of distributed PV growth. According to forecasts from SolarPower Europe and industry institutions, by 2024, Germany’s cumulative installed capacity of commercial and industrial photovoltaics will reach 22.5 GW, marking a growth of over 10% compared to the previous year and maintaining its leading position in Europe. Italy ranks second with 11.8 GW, where small and medium-sized enterprises in high-irradiation regions such as Apulia and Calabria are actively responding to tax incentive policies, accelerating the adoption of rooftop PV systems. France currently has a cumulative capacity of 9.2 GW, and the increase in CRE bidding mechanisms and signed PV PPAs is also facilitating more commercial project implementations. The Netherlands, leveraging urban rooftop resources and policy support, has achieved a cumulative capacity of 7.6 GW. Poland, as a representative of emerging markets, reached 5.3 GW in cumulative installed capacity by 2024, driven by EU funding and a local high electricity price environment, with an expected 1.5 GW in new installations. Medium-sized commercial and industrial photovoltaics projects are showing strong growth momentum.

Note: All 2024 figures are estimated based on publicly available data from SolarPower Europe, IRENA, national energy agencies, and projected market trends.

With the support of policy incentives, technological progress, and innovation in business models, Europe’s commercial and industrial photovoltaics market is gradually forming a relatively mature development system.

- On the policy level, governments across Europe have generally strengthened their support for commercial and industrial photovoltaics. Germany has further increased financial subsidies for the “self-consumption” model; Italy attracts corporate investments through tax deductions and feed-in tariff incentives; since 2023, France has mandated rooftop PV systems for all new and renovated commercial buildings; the Netherlands continues its “net metering” policy while offering grid access priority to large-capacity systems. Under these conditions, regions with high electricity prices, such as southern Germany and southern Italy, have become areas with the highest return on investment and the most enthusiastic corporate participation.

- On the technology level, high efficiency and intelligence have become mainstream in system configurations. High-efficiency technologies such as TOPCon and HJT continuously push the limits of power generation per unit area, especially suitable for commercial buildings with limited rooftop space; the integration of smart inverters and remote operation platforms has significantly improved system visibility and operational efficiency; some high-electricity-price countries have also begun pilot applications of C&I energy storage systems, used for peak shaving and improving self-consumption ratios.

- In terms of business models, the European market is evolving toward a diversified and flexible combination. Beyond the traditional “self-funded, self-consumed” approach, more and more companies are rapidly deploying PV projects through zero-investment rooftop PV leasing or third-party investment and operation models; long-term PPA models are also maturing, achieving an organic integration of energy use, financing arrangements, and ESG strategies.

Overall, commercial and industrial photovoltaics in Europe is transitioning from a “launch phase” to an “acceleration phase.”

So, what is driving this continued growth?

What are the five main drivers of growth for commercial and industrial photovoltaics in the next 10 years?

As the energy structure continues to evolve and corporate green transformation deepens, Europe’s commercial and industrial photovoltaics sector will enter a new growth cycle driven by multiple forces. From policy orientation to market demand, from technological breakthroughs to financial mechanisms, the following five drivers will become the core forces over the next decade.

1. Policy-driven: Accelerated regulation and mandatory implementation

The EU has explicitly included distributed PV in the European Green Deal and REPowerEU plan as a key tool for achieving climate neutrality and energy independence. Member states are continuously reinforcing mandatory rooftop PV deployment mechanisms. Since 2023, France has required that new and renovated commercial building rooftops must install PV systems. Italy’s draft PNIEC 2030 also proposes 52 GW of new PV capacity by 2030, a substantial portion of which is expected to come from C&I rooftops.

At the same time, supportive policies such as tax deductions (e.g., Italy’s Superbonus), simplified administrative approval processes, and accelerated grid access have significantly lowered project implementation thresholds, improved investment certainty, and driven various enterprises to accelerate the rollout of self-consumption PV projects—providing strong support for the large-scale deployment of commercial and industrial photovoltaics.

2. Enterprise transformation: ESG orientation and energy autonomy advancing in parallel

The implementation of regulations such as the Carbon Border Adjustment Mechanism (CBAM), combined with medium- to long-term energy price uncertainty and the dual pressure of peaking and neutralizing carbon emissions, has made energy the “second cost center” in corporate strategy.

An increasing number of European companies are incorporating green electricity into their ESG performance systems and net-zero commitments. Many clients in manufacturing, retail, logistics, and other industries are achieving controllable carbon footprints through PPAs, certified green electricity purchases, or self-built systems. Participation in international initiatives like RE100 and SBTi continues to grow. Enterprises are shifting their perception of PV projects from cost-saving tools to “strategic assets” with compliance value, financing potential, and brand influence. This trend is also reflected in supply chain pressure, as more upstream suppliers are being asked by downstream clients to provide green energy certificates or transparency in energy consumption.

3. Technological innovation: Efficiency breakthroughs driving cost reduction and performance improvement

High-efficiency cell technologies such as TOPCon, HJT, and IBC are driving continuous improvements in module efficiency. Progress in PV technology is continuously reducing the levelized cost of electricity (LCOE), effectively addressing the issue of limited roof space and installed capacity for small and medium-sized C&I enterprises.

Meanwhile, smart inverters, AI-driven O&M platforms, and bidirectional energy storage devices are achieving integrated “generation-storage-management” solutions, optimizing system PR values, and significantly lowering failure rates and maintenance costs. Particularly in countries like Germany and the Netherlands, the combination of commercial and industrial photovoltaics + storage + energy efficiency management systems is gradually being standardized. System integrators are evolving from simple installers to comprehensive energy service providers.

4. Business model innovation: Diverse financing and risk mitigation go hand in hand

Previously, the greatest barrier to commercial and industrial photovoltaics was the upfront capital expenditure and project complexity. Today, this issue is being overcome by innovative business models. Zero-investment rooftop PV leasing, long-term PPAs, and third-party investment mechanisms such as Energy Service Companies (ESCOs) have become mainstream paths.

Large developers and financial institutions have jointly launched standardized financing schemes that bundle PPAs, insurance, and maintenance—substantially lowering entry thresholds for SMEs. At the same time, green bonds, sustainable development loans, and project financing tools are maturing, making the “assetization” and “securitization” of PV systems increasingly clear. For example, in the Italian market in 2023, nearly 30% of commercial and industrial photovoltaics projects were completed through structured financing, demonstrating strong capital acceptance and replicability.

5. Market transformation: Mechanism restructuring empowers distributed development

Europe’s energy market is undergoing deep structural reform. Multiple countries are promoting electricity price liberalization and building spot and capacity market mechanisms, creating conditions for distributed energy integration and flexible pricing.

Enterprises can directly participate in the electricity market through models like “self-consumption + surplus grid feed-in,” enabling business opportunities such as peak-valley arbitrage, demand response, and virtual power plants. As policies gradually relax on new models such as energy communities, shared PV, and public resale, C&I users are no longer just “electricity consumers” but also “traders” and “regulators,” greatly enhancing the asset attributes and tradability of PV systems.

Which countries will lead this wave of growth?

In the coming decade of growth for commercial and industrial photovoltaics in Europe, different countries will show stratified development patterns due to differences in policy timelines, market foundations, and enterprise participation levels. Overall, there will be both mature leading countries with solid policy and market foundations, as well as emerging markets with cost advantages and policy benefits.

1. Mature Markets

Germany: Strong policy continuity and well-developed PPA ecosystem

As a pioneer in European solar development, Germany has accumulated a comprehensive market mechanism and industrial chain system in the commercial and industrial photovoltaics sector. The Renewable Energy Sources Act (EEG) provides stable subsidies for commercial and industrial photovoltaics projects, with recent emphasis on encouraging “self-consumption” models and PPA transactions. Since 2024, Germany has implemented higher capacity limits and faster grid connection approval processes to accelerate the rollout of medium- and large-scale rooftop systems. Additionally, German enterprises typically have long-term energy planning awareness, promoting structural maturity in the commercial and industrial photovoltaics market.

Italy: Dual advantages of high southern irradiation and tax incentives

Italy’s commercial and industrial photovoltaics market displays strong regional differentiation. Southern regions such as Apulia and Sicily enjoy abundant solar resources, making them among the lowest LCOE zones. National-level tax deduction policies (e.g., Superbonus 110% and alternative mechanisms) effectively reduce total project costs. Furthermore, with adjustments to the National Energy and Climate Plan (PNIEC) targets, Italy is encouraging more C&I users to accelerate PV deployment through “build-and-use” approaches.

France: Parallel progress of CRE tenders and PPA mechanisms

The French market is driven by government-led CRE tendering mechanisms, which regularly issue bids for C&I rooftop projects and provide fixed tariff support. Since 2023, PPAs have gradually gained popularity among medium- and large-sized enterprises, especially retail, logistics, and manufacturing clients who are increasing their demand for “green procurement,” stimulating project development enthusiasm. French policies also encourage Building-Integrated Photovoltaics (BIPV), offering additional growth opportunities for urban commercial buildings.

2. Emerging Markets

Poland, one of the fastest-growing solar markets in Europe in recent years, is shifting its focus from residential PV to the expansion of medium-sized rooftop systems in the C&I sector. High electricity prices are prompting small and medium-sized manufacturing companies to proactively seek PV alternatives. This is further supported by the dual drivers of the EU Modernization Fund and REPowerEU financing. Although grid connection and access mechanisms still require optimization, Poland has strong market flexibility and high marginal returns, making it a promising “latecomer” with catch-up potential.

In addition to Poland, Eastern European countries such as the Czech Republic, Romania, and Hungary are also updating their national energy strategies. Most of them have set targets to double their distributed PV capacity by 2030 and are supporting commercial and industrial photovoltaics development through streamlined approvals, reduced tax burdens, and expanded fiscal allocations.

How can businesses seize this energy transition opportunity?

In the face of Europe’s transforming energy structure, commercial and industrial users that complete early-stage energy planning will gain long-term advantages in cost control, compliance fulfillment, and brand development. Surrounding the feasibility assessment of PV deployment, business model selection, risk-return analysis, and partner selection, enterprises should formulate a scientifically grounded energy strategy to achieve sustainable energy optimization.

1. Evaluation of rooftop building resources for commercial and industrial photovoltaics

The technical suitability of building resources directly determines the feasibility and economic viability of PV system deployment.

- Electricity load structure: Having a consistent and stable daytime electricity load is key to improving the “self-consumption” ratio.

- Roof space and structural conditions: Flat, unobstructed, and structurally sound rooftops are more suitable for PV deployment.

- Property rights and usage duration: Clear rooftop ownership and sufficient remaining building lifespan (typically 20–25 years) to match the PV system’s operating cycle.

- Grid connection and technical readiness: Availability of distribution infrastructure, spare grid capacity, and whether additional approval is required for grid connection.

2. Strategic judgment in business model selection

Depending on the enterprise’s financial structure, energy management goals, and investment expectations, three mainstream business models are currently available—though not every model suits all C&I users:

Self-invested construction model (CAPEX): The enterprise fully funds and builds the PV system, receiving all power generation benefits. Suitable for capital-abundant businesses that value long-term returns and energy autonomy.

Zero-investment rooftop PV leasing model: A third party invests, the enterprise gains benefits without investment, while the investor pays annual rent and offers discounted electricity—ideal for SMEs or asset-light organizations seeking “zero-investment” PV use.

PPA (Power Purchase Agreement): Locks in green electricity prices through long-term power supply contracts, suitable for companies with multiple sites, large corporate groups, or those with ESG disclosure requirements.

Comparison of Three Commercial and Industrial PV Cooperation Models

| Comparison Dimension | Self-Invested Construction | Zero-Investment Leasing Model | PPA Model |

|---|---|---|---|

| Asset Ownership | Owned by the enterprise | Owned by the property owner after expiration | Owned by a third party |

| Initial Investment | High | None | None |

| Long-Term Returns | All returns go to the enterprise | Rental income / discounted green electricity | Cost savings through low-price electricity |

| Suitable For | Enterprises with sufficient capital and long-term return goals | SMEs and asset-light enterprises | Group enterprises with stable electricity loads |

| Contract Term | No fixed term | Negotiated based on actual situation | 10–20 years |

| Financing Pressure | High | None | None |

| ESG Compatibility | Strong | Medium to Strong | Strong |

3. Assessment of returns and risks

Deploying a PV system is a long-term investment decision. Before launching a project, businesses should evaluate economic returns and potential risks from multiple dimensions:

Core financial indicators: Including IRR (Internal Rate of Return), LCOE (Levelized Cost of Electricity), and payback period to assess overall project viability.

Electricity price and policy volatility: Analyze current and future local electricity price trends, and whether subsidy mechanisms and tax incentives are stable.

Grid connection efficiency and approval timeline: Queue time and administrative complexity for grid connection directly affect the timeline for realizing returns.

System O&M and performance guarantees: The quality of components, inverter performance, and long-term O&M capacity critically affect actual system output.

4. Logic of partner selection

The long-term effectiveness of a PV system depends not only on the design plan but also on the comprehensive delivery, service, and support capabilities of the chosen partner.

Qualifications and certifications: Whether the products meet mainstream EU certifications such as IEC, TÜV, CE to ensure compliance and safety in the target market.

Industry experience: Whether the partner has experience with various types of C&I projects and is familiar with policies, grid procedures, and regulatory requirements in different countries.

Local delivery capability: Whether they have local warehousing, technical support, and after-sales service in Europe to ensure response time and spare part supply.

System performance and service commitments: Whether they offer a complete warranty period, energy yield monitoring, and remote diagnostics.

As a PV module manufacturer focused on the European market for many years, Maysun Solar has been deeply involved in the C&I distributed sector since 2008. With a comprehensive local warehousing and service network across Europe, its high-efficiency modules have been widely applied on factory rooftops and commercial facilities in Germany, Italy, France, and other regions—helping businesses reduce electricity costs while increasing the share of green energy use and brand value.

Opportunities and challenges coexist — who will dominate the new European energy landscape?

As the EU’s carbon neutrality strategy continues to advance, commercial and industrial photovoltaics are rapidly integrating into corporate energy structures under the combined impetus of policy incentives, market mechanisms, and technological maturity. They have become a key tool for enhancing competitiveness and building green assets. However, this transformation is not without structural challenges that cannot be ignored—such as insufficient grid access capacity, high barriers to financing, lengthy approval processes, and a shortage of skilled professionals—all of which pose real constraints on project implementation efficiency and predictability.

Nevertheless, commercial and industrial photovoltaics is no longer an optional choice but an indispensable part of corporate energy strategy. Especially in the next decade, as carbon costs become more explicit, green premiums gradually materialize, and both policy and capital markets place greater emphasis on the share of clean energy use, early adopters will gain predictable financial returns and brand advantages. On the contrary, companies that delay entry may face higher energy costs and greater supply chain compliance pressure.

Amid energy price volatility, regulatory pressure, and the growing need for sustainability, photovoltaics are no longer a “nice-to-have” green accessory for companies, but a “core asset” that determines future cost structures and competitive advantages.

The next decade will belong to those companies that dare to plan ahead and are flexible in their response.

Whoever can complete the transformation from “energy consumer” to “proactive energy manager” first will gain the pricing power, brand power, and development rights in the emerging distributed energy landscape in Europe.

Maysun Solar will continue to work hand in hand with partners across Europe to provide commercial and industrial users with high-efficiency, reliable PV modules and local service support—helping more companies turn crises into opportunities and move forward steadily in the energy transition.

Since 2008, Maysun Solar has been both an investor and manufacturer in the photovoltaic industry, providing zero-investment commercial and industrial rooftop solar solutions. With 17 years in the European market and 1.1 GW of installed capacity, we offer fully financed solar projects, allowing businesses to monetize rooftops and reduce energy costs with no upfront investment. Our advanced IBC, HJT and TOPCon panels, and balcony solar stations, ensure high efficiency, durability, and long-term reliability. Maysun Solar handles all approvals, installation, and maintenance, ensuring a seamless, risk-free transition to solar energy while delivering stable returns.

References

SolarPower Europe. EU Market Outlook for Solar Power 2023–2027. Brussels, 2023. https://www.solarpowereurope.org

IRENA (International Renewable Energy Agency). Renewable Capacity Statistics 2024. Abu Dhabi, 2024. https://www.irena.org

European Commission. REPowerEU Plan – Accelerating the Green Transition. Brussels, 2022. https://commission.europa.eu

European Environment Agency (EEA). Trends and Projections in Europe 2023: Tracking Climate Progress. Copenhagen, 2023. https://www.eea.europa.eu

Clean Energy Wire. Germany’s Renewable Energy Policies and Solar Incentives Overview. Berlin, 2023. https://www.cleanenergywire.org

You may also like:

Forecast and Response: Seizing the Next Decade’s Growth Dividend in Europe’s Commercial and Industrial Photovoltaics Market

Maysun Solar analyzes the growth trends of commercial and industrial photovoltaics in Europe over the next ten years, from policies and ESG to technological innovation, helping companies seize the initiative in the energy transition.

How to Calculate Solar System ROI and Optimize Long-Term Returns?

Solar power is becoming a key solution for businesses to reduce costs and improve efficiency. Accurately calculating ROI and optimizing long-term returns are essential to maximizing investment value.

Will Agrivoltaics Affect Crop Growth?

Agrivoltaics combines solar energy and agriculture to reduce up to 700 tons of CO₂ per MW, improve water use, and boost crop growth for sustainable farming.

6.5 Billion Loss Hits Photovoltaics: Reshaping or Elimination?

In 2025, the photovoltaic market may see a turnaround as some companies take early action. A €6.5 billion loss is driving businesses to explore new growth areas like energy storage and hydrogen. Which giants will break through? Industry transformation is accelerating!

What’s New in Solar Energy (March 2025)

March’s solar news highlights include rooftop solar meeting two-thirds of global demand, China’s market reforms potentially boosting solar demand and module prices, France revising solar targets in PPE 3, and challenges in Europe with declining capture rates and price volatility.

Zero-Investment Solar Projects: How to Earn Passive Income Through Rooftop Leasing?

Monetize your idle rooftop and earn stable annual rent! With the photovoltaic rooftop leasing model, businesses can generate long-term revenue without investment, reduce operating costs, and achieve a green transition.