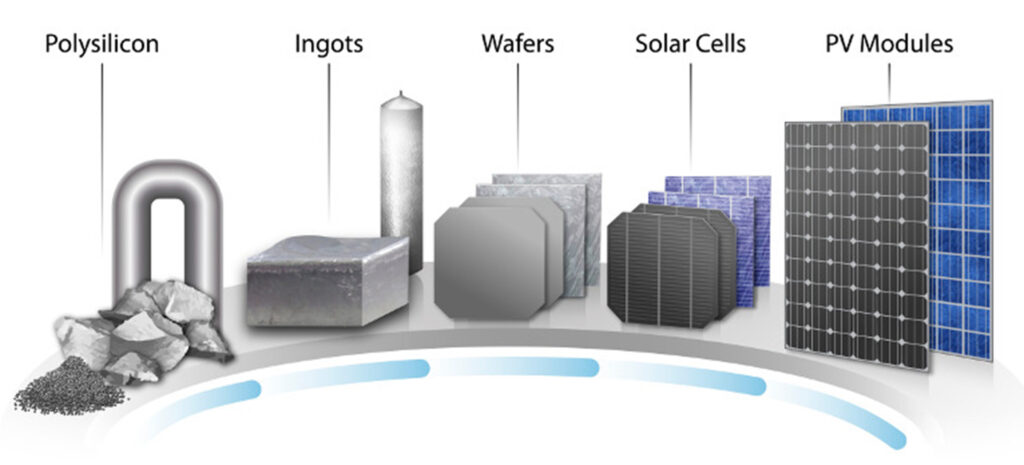

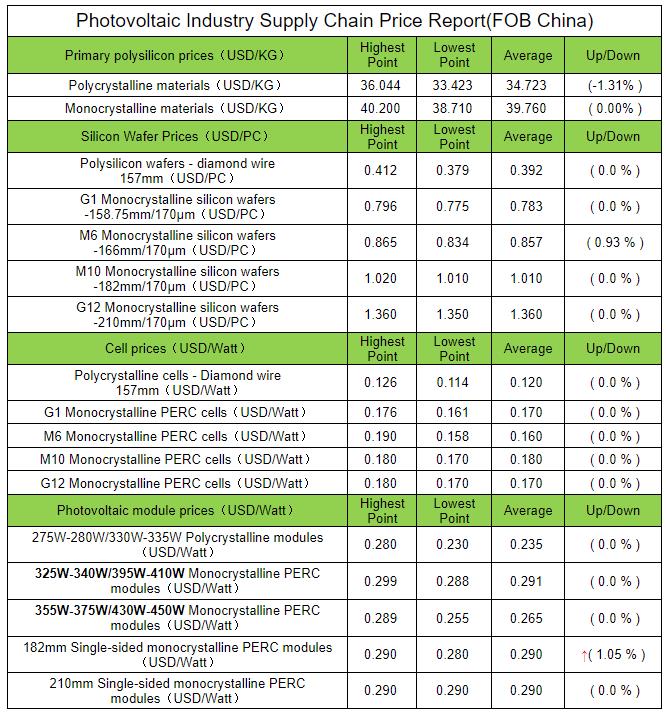

The price of solar silicon material this week was the same as last week, mainly because there was not much remaining available for sale. The quotation for the overall monocrystalline material remained at around RMB 39.76 USD/KG.

Currently, all solar silicon material enterprises have signed orders for June. Even some companies have signed orders until July, and the supply of solar silicon materials is still tight. It is expected that a small number of scattered orders will slightly increase the price of solar silicon materials before the end of June, and the price of solar silicon materials will continue to rise in the short term;

Observing the production operation and shipment of solar silicon materials, according to statistics, the supply of solar silicon materials in June reached 70,250 tons (26.51GW), an increase of 6.28% from May, but compared with the huge downstream silicon wafers Production capacity and the current high operating rate of the entire industry chain, the supply of solar silicon materials is still tight;

Solar wafers: prices remain stable

The mainstream transaction price of M10 is around USD1.01/PC, and the mainstream transaction price of G12 is around USD1.36/PC. This week, there are few new orders for solar wafers, the terminal has shown signs of fatigue for the continuous high prices of the industry chain, and the enthusiasm for purchasing solar cells has weakened. Due to the good demand for M10 in the early stage, some wafer companies have switched production sizes and vigorously produced M10 solar silicon. Now the downstream supply has slowed down, and some companies have reported that the price of M10 orders has fluctuated, the bargaining space has become larger, and the market game atmosphere is strong. Based on cost pressure, the price of solar silicon wafers is expected to continue to stabilize.

In June, the comprehensive operating rate of silicon wafer factories reached 77%. Because the supply of silicon materials is still insufficient, the output of each company has decreased to varying degrees compared with the original plan. As the production capacity of downstream solar cell companies is almost full, the demand for silicon wafers is still relatively strong in the short term;

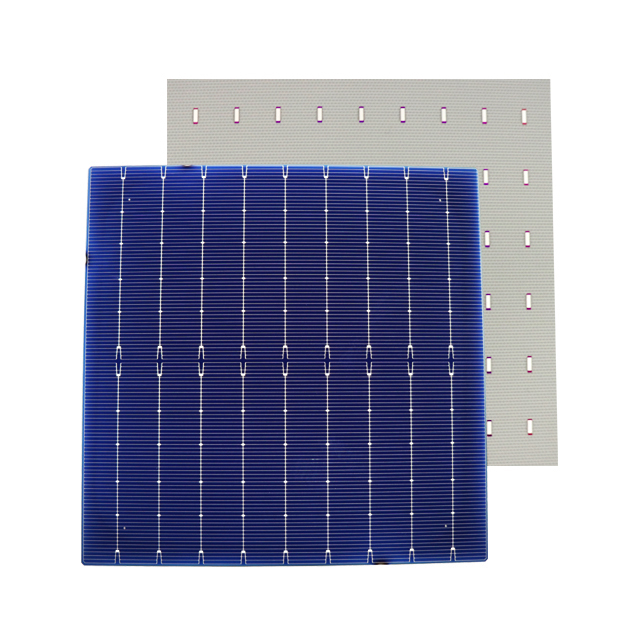

Solar cells: no significant price adjustment

The mainstream transaction price of monocrystalline M6 solar cells is around USD 0.17/W, the mainstream transaction price of M10 cells is around USD 0.18/W, and the mainstream transaction price of G12 cells is around USD 0.17/W. Due to the decrease in demand for monocrystalline M6 cells, the market resources are very limited, and the process of exiting the market is accelerated. Recently, some solar cell companies have upgraded 182-size cells through 166 production lines, converted 182-size production lines with 210 production lines, and increased new production capacity. The overall 182-size cell production capacity has increased significantly. However, the supply and demand of 182-size cells still remain tight, and prices are still likely to rise.

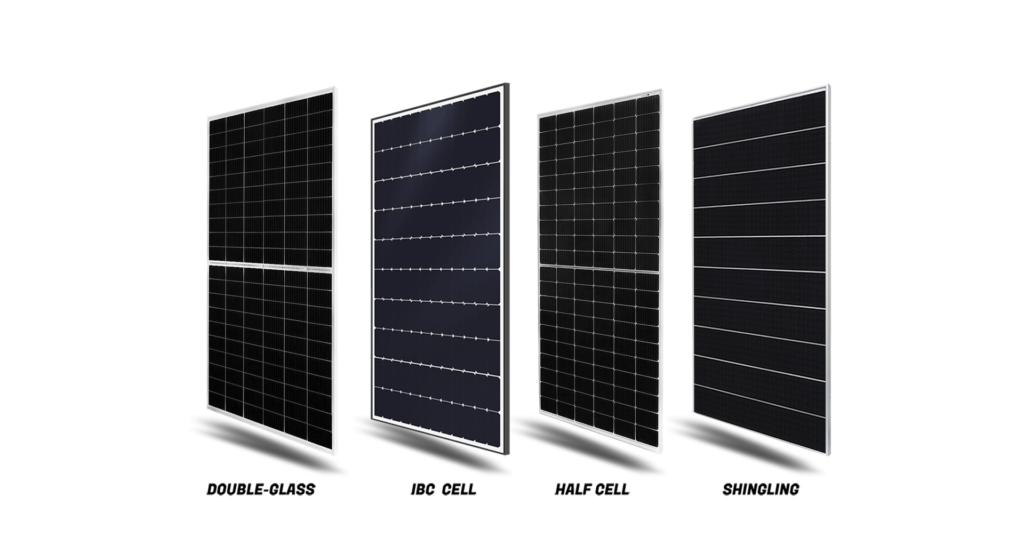

Solar modules: The prices were generally stable, and the prices of 182MM solar modules rose slightly.

This week, the mainstream transaction price of mono 166 solar modules is around USD 0.28/W, the mainstream transaction price of mono 182 modules has risen to around USD 0.29/W, and the mainstream transaction price of mono 210 modules is around USD 0.29/W. The price of 182 solar cells rose in the previous period, resulting in a slight increase in the price of 182 modules this week, which has been flat with the price of 210 modules. At present, due to good overseas demand, first-line component companies are full of orders, and most of them maintain full production. However, the acceptance of high-priced components by domestic centralized ones is still low, and distributed demand continues. The spread is around USD0.0074-0.010/W. Recently, Europe passed the “Resolution on Anti-Forced Labor Customs Measures”, prohibiting “forced labor” products from entering the European market. Considering the urgent demand for European installations and China’s huge production capacity, some domestic enterprises have already prepared relevant materials. It is expected that the relevant measures will actually be implemented. The impact is limited, and component demand will continue. For the N-type components, the quotation range narrowed this week, and the base price rose. The quotation in the market was USD 0.31-0.32/W.

In terms of auxiliary materials, glass prices continued to stabilize this week. The mainstream transaction price of 3.2mm glass was about USD 4.24/㎡, and the mainstream transaction price of 2.0mm glass was about USD 3.35/㎡. The price reduction psychology of module companies is obvious. Glass companies are unwilling to make concessions due to high cost pressures. The two sides are deadlocked. It is expected that glass prices will remain stable in the short term.

PV module price forecast for next week:

This week, solar silicon materials are still on the rise. With the continued overseas demand for solar modules and the high acceptance of module prices, there is still room for module prices to rise. Customers with photovoltaic projects should purchase as soon as possible to reduce cost losses.

Following such confusing times, people often find themselves locked up in a dilemma on the decision of installing the appropriate PV module for their homes, offices, etc. And for that very reason, we are here ready to assist you in whatever you need. Contact us now at Whatsapp: +86 159 2091 1832 and get a quote.