Table of Contents

Overview of Structural Changes in European Commercial and Industrial Photovoltaic Policies and the Trend Toward Regional Adaptation

Against the backdrop of accelerated energy restructuring across Europe, commercial and industrial photovoltaic systems have increasingly become a strategic component of corporate energy planning.

What was once a supplementary solution to combat high electricity prices has now evolved into a multifunctional tool that helps businesses respond to carbon regulations, optimize energy structure, and enhance energy independence. Especially under the dual pressure of rising policy obligations and operational costs, 2025 marks a critical turning point—deployment strategies are shifting from tactical decisions to structural ones.

Looking across major European countries, although all operate under a unified EU climate framework, significant differences remain in how incentives are offered, how electricity is priced, grid connection procedures, and rooftop usage regulations. For example, while Germany, Italy, and France all provide formal support mechanisms, their project implementation paths and fiscal outcomes differ widely. These differences are not incidental but are the result of long-standing national and local policy systems.

At the EU level, policy is transitioning from incentive-driven to obligation-based. Initiatives such as REPowerEU and the Green Industrial Plan explicitly call on member states to accelerate rooftop solar deployment. A series of binding regulations are taking shape, including mandatory solar installations for new commercial buildings, requirements for green procurement, and carbon footprint disclosures across the supply chain. For companies, deploying solar is no longer optional—it’s directly tied to compliance, access to renewable energy, and ESG performance.

Meanwhile, businesses are also rethinking their internal logic for solar adoption. Instead of calculating isolated electricity savings, many are now focusing on system-wide goals such as energy stability, tax optimization, credit ratings, and brand transparency. In various sectors, access to self-generated green power is becoming a hidden factor influencing supply chain positioning, project evaluations, and even financing terms.

With both policy and business needs evolving, the way companies approach deployment is also changing. It’s no longer a one-size-fits-all process. Deployment now requires multi-layered coordination, including site selection, tax modeling, policy alignment, and business model adaptation. Whether a project is viable depends not just on rooftop availability but on a combination of national policy strength, ease of grid access, electricity price structure, contractual flexibility, and the company’s financial and compliance objectives. This marks a new phase that requires comprehensive evaluation across location × rooftop resource × deployment model × policy alignment.

The year 2025 represents the moment when these structural shifts become fully visible. Businesses must rethink what “deployment” means—no longer just a technical project, but a strategic decision that spans energy infrastructure, capital operations, market positioning, and regulatory compliance.

Comparative Analysis of Incentive Mechanisms and Grid Connection Policies for Commercial and Industrial Solar in Major European Countries

The policy environment of a project’s host country is often the primary factor businesses consider when planning how to deploy commercial and industrial solar systems locally. Although EU member states share common climate targets, they differ significantly in terms of incentives, grid connection rules, and administrative procedures—resulting in increasingly divergent deployment paths. These differences can directly impact the underlying financial models, operational efficiency, and suitability of various deployment models for companies.

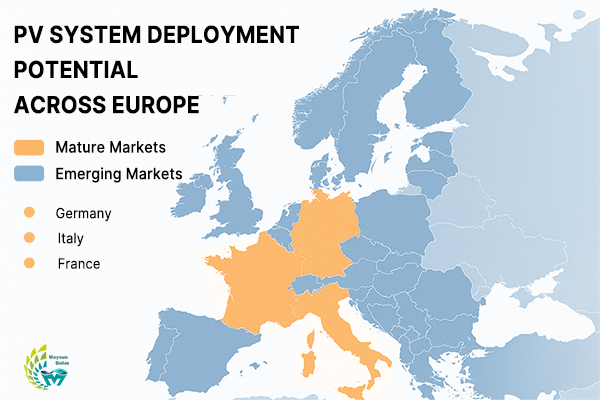

To better assess the alignment between deployment models and regional conditions, the European market can generally be divided into two categories:

Mature markets: Countries like Germany, Italy, and France have well-established incentive schemes, diverse support models, and strong compatibility with various deployment strategies.

Emerging or high-potential markets: Countries such as Portugal, Poland, Czech Republic, and Romania offer excellent solar resources or promising policy conditions, but also present challenges such as long approval cycles, complex grid access, and frequent policy changes.

The table below outlines the differences across seven countries based on five key dimensions, helping businesses make more informed decisions:

Key Factors Comparison for Solar Deployment by Country

| Country | Incentive Strength | Grid Connection Ease | Solar Resource | Approval Timeline | Rooftop Suitability |

|---|---|---|---|---|---|

| Germany | Medium | Relatively Complex | Medium | Medium | Medium-High |

| France | Medium-High | Medium | Medium | Medium | Medium |

| Italy | High | Good | High | Medium-Low | High |

| Portugal | High | Average | Very High | Slower | High |

| Poland | Medium | Medium | Medium | Medium | Medium-Low |

| Czech Republic | Medium-Low | Slow to Average | Medium | Slow | Medium-Low |

| Romania | Medium | Relatively Complex | Medium | Slow | Unstable |

Note: The evaluation dimensions in the table are based on policy updates and industry feedback from 2024–2025, aiming to illustrate the structural deployment challenges and opportunity landscape across different markets.

Reasons Behind Deployment Compatibility Differences

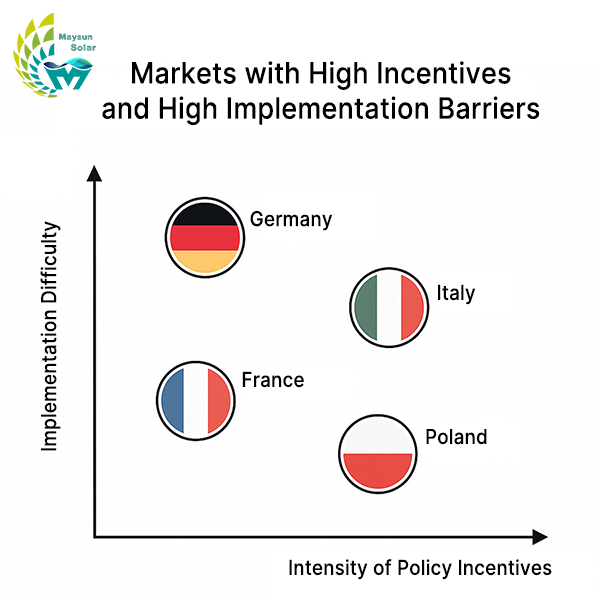

While most countries have established incentive mechanisms at the policy level, the strength of incentives does not directly correspond to the actual efficiency of project execution. What truly determines deployment feasibility is the alignment between incentive schemes, administrative systems, and grid connection pathways.

Italy, especially in the southern regions, offers unique advantages due to its strong solar resources and clear policy support. Combined with a low LCOE, this enables companies to adopt diversified deployment models such as self-investment, PPA, or zero-investment approaches.

France performs consistently in terms of policy coherence and rooftop suitability, laying a strong foundation for standardized urban rooftop deployments.

Germany, as a mature market for commercial and industrial photovoltaics, has a well-established system, stable policy rhythm, and high levels of grid standardization. It is a key region for standardized deployments and medium- to long-term investment models. Especially in industrial parks or logistics zones where rooftop ownership is high and loads are stable, Germany supports light-asset models like PPA or zero-investment deployment. However, tightening grid capacity and decentralized approval powers in some federal states may prolong the connection timeline. Companies should assess local coordination capacity early.

In high-potential markets, while incentives exist, non-economic challenges remain. Portugal has excellent solar resources and clear incentive direction, but a centralized and slow approval process. Poland benefits from a favorable price gap for self-consumption, though policy changes are frequent and storage systems remain underdeveloped. Czech Republic and Romania, though backed by EU funds, struggle with unclear grid access systems and limited rooftop availability, which affect both deployment efficiency and return predictability.

Overall, when developing deployment strategies across countries, companies should assess regulatory frameworks, execution chains, and grid access feasibility, rather than relying solely on subsidies or expected returns.

Deployment Strategies Should Be Tiered to Match Market Maturity

Due to differences in policy maturity and implementation predictability, businesses should adopt tiered rollout strategies suited to each market, ensuring dynamic balance between risk control and resource efficiency.

In mature markets such as Germany, France, and Italy, companies can leverage stable policy frameworks and well-developed financing channels to promote commercial and industrial solar deployment through a model of standardized rollout + light-asset expansion. By adopting approaches such as self-investment, PPA, or zero-investment models, businesses can unlock rooftop resources and secure long-term, stable returns.

For high-potential markets like Portugal, Poland, Czech Republic, and Romania, a recommended strategy is window-based pilots combined with localized partnerships. Collaborating with local EPCs or developers to launch demonstration projects allows gradual testing of policy compatibility, cost structures, and compliance conditions, helping to avoid the risks associated with heavy upfront capital investments.

As the structure of commercial and industrial solar policies in Europe continues to diverge, a single-model replication strategy is becoming increasingly inadequate.

Companies need to establish a deployment framework based on multi-country parallelism × tiered strategies × flexible models, ensuring a dynamic balance between return expectations and execution efficiency.

Deployment Model Selection Strategies for Different Types of Enterprises

The widespread adoption of commercial and industrial solar has made differences in deployment capability, financial structure, and rooftop resources key variables in determining how enterprises approach deployment. The traditional one-size-fits-all deployment model is no longer sufficient to meet today’s diverse planning needs. To maximize returns, companies must start from their own conditions and choose the model that best fits their profile.

Five Key Dimensions for Deployment Strategy Decisions

Energy consumption structure and load characteristics: Evaluate energy usage levels, load stability, and capacity for consuming self-generated green power

Asset and site structure: Assess rooftop access rights, ownership ratio, and site concentration

Financial capacity and investment preference: Consider whether the company has capital for self-investment or prefers outsourced deployment

ESG pressure and compliance requirements: Includes client audits, carbon footprint disclosure, and regulatory compliance obligations

Organizational and management capacity: Involves internal coordination mechanisms, contract management, and execution ability across multiple sites

These five factors form the foundation for companies to build a tailored deployment strategy.

Optimal Deployment Paths for Three Typical Enterprise Types

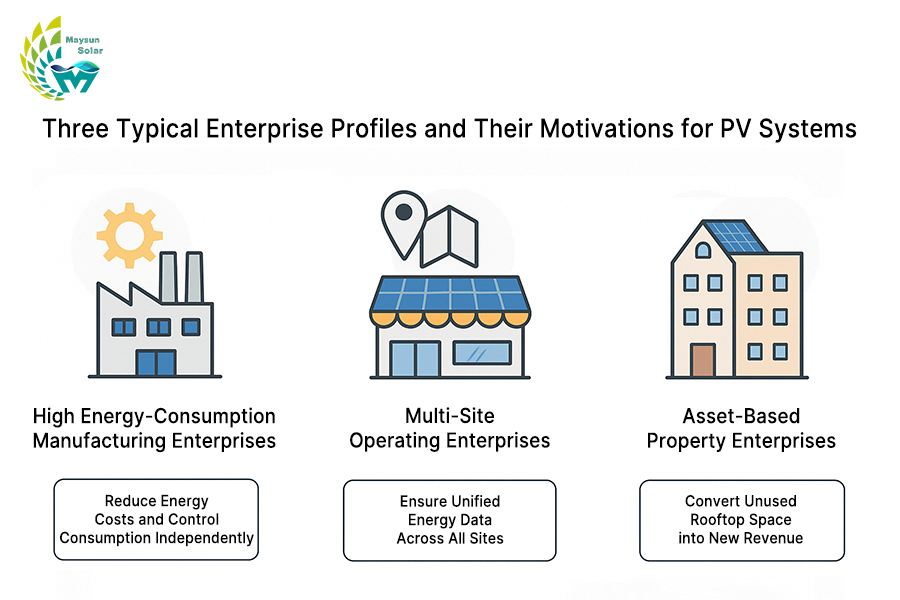

Enterprises can generally be categorized into three typical types based on their characteristics:

Recommended Deployment Paths for Three Types of Enterprises

| Enterprise Type | Core Characteristics | Recommended Deployment Model |

|---|---|---|

| High Energy-Consumption Manufacturing Enterprises | Large electricity demand, high rooftop autonomy, mature tax and financial planning | Self-built systems / Long-term PPA / Zero-investment cooperation |

| Multi-site Operating Enterprises | Wide site distribution, need for centralized management, focus on energy stability and reporting | PPA / Zero-investment deployment |

| Asset-based Property Enterprises | Low self-consumption ratio, focus on monetizing assets, exchanging rooftops for resources | Rooftop leasing zero-investment model / Green electricity resale model |

Although the primary deployment paths vary across the three types of enterprises, utilizing idle rooftop resources in exchange for returns has become a flexible option that businesses are increasingly adopting based on their financial capacity and management preferences:

For manufacturing enterprises with limited capital or longer payback periods, light-asset cooperation at specific sites can enable access to green electricity.

Multi-site operators can implement unified deployment through external energy service providers, which helps control costs and facilitates centralized ESG reporting.

Asset-based enterprises can convert underutilized rooftop space into tangible revenue by partnering through “rooftop-for-electricity” models.

Structural Comparison of the Three Deployment Models

The three mainstream deployment models differ fundamentally in their structural mechanisms and require systematic comparison. Enterprises should flexibly combine these models based on their own organizational structure to achieve a balanced outcome in both financial performance and regulatory compliance.

Structural Comparison of the Three Deployment Models

| Model Type | Funding Source | Control & Management Rights | Compliance & ESG Value | Risk & Responsibility Structure | Suitable Scenarios & Enterprise Types |

|---|---|---|---|---|---|

| Self-Built by Enterprise (CAPEX Model) | Self-funded by the enterprise | Full ownership and operational control | Included as fixed assets, supports carbon disclosure | Enterprise bears the risks, requires financial and tax capability | Manufacturing / Heavy Industry Projects |

| PPA Contract Model | Led by external investors | Allocation secured by contract | Stable green power supply, supports long-term ESG disclosure | Shared responsibilities within contract duration | Multi-site operators / Enterprises with high ESG pressure |

| Zero-Investment Rooftop Deployment | Fully funded by the investor | Returns exchanged for rooftop usage rights | Fulfills green power targets, fits light-asset strategies | Investor bears main technical and financial responsibilities | Property-based / Budget-constrained enterprises |

The key to choosing a deployment model lies not in the model itself, but in whether it aligns with the combined logic of enterprise type × national context × model constraints.

Trends in Incentive Windows and Deployment Timing Assessment

European policy is shifting from encouraged deployment to mandatory deployment, and the window for incentives in commercial and industrial solar is undergoing a structural contraction.

Support mechanisms that once focused on financial subsidies and feed-in tariffs are now being replaced by regulatory requirements, carbon disclosure obligations, and mandatory installation rules.

This transition poses new challenges for the deployment pace of enterprises:

those who act early can secure incentives and returns, while those who delay will face diminishing incentives and more complex approval processes.

Germany: Decreasing Feed-in Tariffs and Grid Pressure Coexist

As a regulatory benchmark for commercial and industrial photovoltaics in Europe, Germany’s EEG subsidy scheme is entering a phase of quarterly reductions around 2025.

Fixed feed-in tariffs are being phased out, and grid-connected projects are shifting to auction-based mechanisms. This is particularly evident in the rooftop solar sector, where incentives for small and medium-sized projects are shrinking.

In addition, several federal states are experiencing grid congestion, and connection quotas have started to be capped.

Project timelines—from registration to implementation—are lengthening, with local grid coordination and capacity playing a major role in approval speed.

For energy-intensive enterprises, failing to deploy within the 2024–2025 window could mean missing out on electricity price spread profits.

Italy: Southern Returns Stand Out, Incentives Begin to Tighten

Southern Italy offers extremely low LCOE and attractive self-consumption returns, making it one of the most profitable regions in the EU for commercial and industrial solar.

However, incentive policies are shifting from broad accessibility to targeted support:

The Superbonus has been significantly scaled back, especially for commercial projects, with tax rebate strength reduced.

Local governments are also tightening approval standards for large-scale projects, requiring stricter architectural coordination and visual impact assessments.

Under these conditions, companies planning to deploy via self-investment, PPA, or rooftop leasing should prioritize southern projects to lock in current tax and electricity benefits.

France: CRE-Centered Mechanism Limits Distributed Deployment

France’s current PV deployment is largely based on the CRE auction mechanism. Although the overall incentive structure remains stable, national energy planning is favoring large-scale projects, shifting quotas away from smaller installations.

As a result, small and medium commercial projects face increasing difficulty in winning bids, leading to a gradual marginalization of C&I solar deployment.

Meanwhile, building energy efficiency laws and carbon disclosure regulations are pushing projects toward high-compliance models.

Companies with available rooftop space should aim to complete deployment before CRE thresholds are raised.

Poland: Incentive Windfall in Decline, Execution Efficiency Remains a Challenge

Among Central and Eastern European countries, Poland is one of the fastest-growing markets for commercial and industrial solar, supported by EU instruments like the Modernisation Fund.

However, this fund is expected to decline between 2025 and 2026, while energy storage and grid connection policies are still in development.

At the same time, local government approval processes remain uncertain, and project advancement is often slowed by administrative inefficiencies.

Enterprises planning to enter via light-asset models should aim to complete registration and grid access as early as possible to hedge against policy shifts.

Around 2025 marks a structural turning point in Europe’s incentive landscape for commercial and industrial solar deployment.

On one hand, some countries are phasing out incentives or raising eligibility thresholds.

On the other, mandatory obligations, green reporting, and energy usage restrictions are being rapidly implemented.

For businesses, the question is no longer “whether to deploy”, but “whether they can complete deployment before the incentive window closes.”

Delays will mean missing out on the synergistic advantages of current fiscal and policy structures, entering a new cycle dominated by regulatory requirements and disclosure pressures.

Therefore, when developing deployment plans, companies must evaluate not only rooftop availability and policy intensity, but also align the timing of:

incentive phase-out × project approval cycle × internal decision-making processes,

in order to complete execution before incentive reductions take effect.

Key Parameters for Evaluating Site Selection and Return Structure in Commercial and Industrial PV Systems

Before deploying a commercial or industrial photovoltaic system, businesses must assess not only resource availability and policy conditions, but also evaluate project feasibility across multiple dimensions—including return structure, compliance pathways, and implementation timeline.

Checklist for Evaluating Site Selection for Commercial and Industrial PV Deployment

| Item | Key Evaluation Criteria | Recommended Action |

|---|---|---|

| Electricity Price | ≥ 0.20€/kWh | Review electricity bills or financial contracts |

| Solar Irradiation | Annual irradiation ≥ 1200 kWh/㎡ | Use EU PV GIS or consult with EPC providers |

| Rooftop Resource | Self-owned or contractually confirmed, structurally compliant | Check property documents and rooftop layout |

| Policy Incentives | Clear and applicable paths for subsidies or tax reductions | Refer to government websites or consult with advisors |

| Grid Connection | No grid congestion, reasonable scheduling | Pre-check capacity with DSO/TSO |

Note: Three Commonly Overlooked Key Factors in Deployment Feasibility

High electricity prices do not always mean high returns: Enterprises should assess the potential for savings based on their load curve and self-consumption ratio, rather than relying solely on electricity price figures.

Strong incentives do not guarantee smooth execution: Even generous policies can present execution risks and hidden costs if the application process is complex or approval timelines are lengthy.

Structural compliance does not ensure rooftop usability: Deployment must also consider ownership rights, lease terms, and modification history, to avoid implementation delays caused by resource-related barriers.

The foundation of a high-return project is not a single parameter advantage, but rather the combination of the right mix × effective execution. Enterprises should operate multiple projects in parallel to compare different models and systematically evaluate the alignment of resources, policies, and financial pathways. This enables precise planning of deployment sequence and timing.

Three Guiding Principles for Developing Commercial and Industrial PV Deployment Strategies in Europe

For companies planning to deploy commercial and industrial photovoltaic systems, the question is no longer “whether to deploy”, but rather “how to deploy in the right place, in the right way, and at the right pace”—especially in today’s context of evolving policies and increasingly diverse deployment pathways.

1. Three-Dimensional Value Model: Returns, Tax, and Compliance

For businesses, commercial and industrial photovoltaics are no longer just a tool for saving electricity—they represent a comprehensive investment decision involving energy structure optimization, tax planning, and compliance management.

Before deployment, companies should evaluate not only power generation returns but also tax deduction potential and carbon disclosure alignment, clarifying the strategic value of PV in terms of ESG audits, credit ratings, and customer compliance expectations.

It is recommended that companies engage financial, tax, and carbon consultants early in the planning phase to jointly assess return on investment, tax optimization, and feasible disclosure paths—thus reducing the cost of future structural adjustments.

2. Strategic Site Selection Based on Policy Strength, Resource Fit, and Replication Potential

High incentives do not automatically lead to high returns. The most suitable sites for deployment are those that combine easy access to incentives, strong resource conditions, and scalable, replicable deployment models.

When planning site selection, companies should prioritize regions where incentives are accessible, rooftop ownership is clear, and deployment models can be extended across multiple sites.

Some countries may offer generous incentives, but uncertain approval procedures or frequent policy changes can hinder large-scale rollout.

In contrast, regions with standardized contract templates and streamlined approval procedures are more suitable for multi-project, parallel deployment.

3. Partner Selection Should Balance Cross-Regional Delivery and Risk Control

C&I PV deployment is a complex undertaking that spans policy, engineering, finance, and compliance management.

Deployment partners should not be limited to EPCs or equipment suppliers. Instead, companies should prioritize integrated service providers with capabilities in cross-regional delivery × zero-investment models × long-term asset management.

In contexts with tight budgets or high compliance pressure, service providers offering zero-investment models and centralized management can significantly reduce trial-and-error costs and regulatory risks, enabling light-asset deployment and green energy adoption at the same time.

Maysun Solar, as an active investor in commercial and industrial photovoltaics across Germany, Italy, and France, supports businesses with zero-investment rooftop leasing models to unlock idle resources, enhance profitability, and build competitive edge—enabling multi-site companies to implement standardized and scalable PV deployment paths.

Facing both the tightening of incentive windows and the acceleration of mandatory green obligations, it is strongly recommended that businesses incorporate PV deployment into their mid- to long-term strategic planning.

This includes setting clear deployment targets and resource schedules within financial years, and securing high-fit regions, quality rooftop resources, and reliable partners early—ensuring a competitive position during the ongoing restructuring of Europe’s policy landscape.

Since 2008, Maysun Solar has been both an investor and manufacturer in the photovoltaic industry, providing zero-investment commercial and industrial rooftop solar solutions. With 17 years in the European market and 1.1 GW of installed capacity, we offer fully financed solar projects, allowing businesses to monetize rooftops and reduce energy costs with no upfront investment. Our advanced IBC, HJT and TOPCon panels, and balcony solar stations, ensure high efficiency, durability, and long-term reliability. Maysun Solar handles all approvals, installation, and maintenance, ensuring a seamless, risk-free transition to solar energy while delivering stable returns.

Reference

European Commission. (2022). REPowerEU Plan. Retrieved from https://commission.europa.eu

SolarPower Europe. (2024). EU Market Outlook for Solar Power 2024–2028. Retrieved from https://www.solarpowereurope.org

IEA – International Energy Agency. (2023). Trends in Photovoltaic Applications: Survey Report of Selected IEA Countries between 2017 and 2022. Retrieved from https://iea-pvps.org

Bundesnetzagentur. (2023). EEG 2023 – Renewable Energy Sources Act (Germany). Retrieved from https://www.bundesnetzagentur.de

GSE – Gestore dei Servizi Energetici. (2023). Photovoltaic Incentives and Guidelines (Italy). Retrieved from https://www.gse.it

Ministère de la Transition Écologique. (2023). Mécanismes d’appel d’offres CRE et politique photovoltaïque en France. Retrieved from https://www.ecologie.gouv.fr

You may also like:

2025 European Photovoltaic Policy Map: Deployment Paths and Regional Strategies for Commercial and Industrial Photovoltaics

A comprehensive analysis of the 2025 European commercial and industrial photovoltaic policy map, focusing on deployment strategies, incentive comparisons, and zero-investment models to support businesses in achieving an efficient and green transition.

Empowering Factories with Solar Energy A Strategic Tool for Controlling Production Electricity Costs

Commercial and industrial solar is becoming a key solution for factories to reduce electricity costs and hedge against price fluctuations. This article systematically analyzes its deployment models, cost advantages, and sustainable value pathways.

How Businesses Can Offset Carbon Taxes with Solar Power

This article analyzes the latest carbon tax policies and photovoltaic deduction strategies, helping European businesses legally reduce taxes, increase profits through solar investment, and achieve a win-win situation for both economy and environment.

Forecast and Response: Seizing the Next Decade’s Growth Dividend in Europe’s Commercial and Industrial Photovoltaics Market

Maysun Solar analyzes the growth trends of commercial and industrial photovoltaics in Europe over the next ten years, from policies and ESG to technological innovation, helping companies seize the initiative in the energy transition.

How to Calculate Solar System ROI and Optimize Long-Term Returns?

Solar power is becoming a key solution for businesses to reduce costs and improve efficiency. Accurately calculating ROI and optimizing long-term returns are essential to maximizing investment value.

Will Agrivoltaics Affect Crop Growth?

Agrivoltaics combines solar energy and agriculture to reduce up to 700 tons of CO₂ per MW, improve water use, and boost crop growth for sustainable farming.