Table of Contents

Introduction to CBAM

1. Why Did the EU Introduce CBAM?

As the challenges posed by global climate change intensify, governments worldwide are accelerating their efforts to achieve carbon neutrality. The European Union, a leader in global carbon reduction initiatives, introduced the European Green Deal in 2019, aiming to achieve carbon neutrality by 2050.

However, the EU’s strict carbon emission quotas and Emissions Trading System (ETS) place local businesses at a disadvantage compared to international competitors. To prevent carbon leakage—where high-emission industries relocate production to countries with less stringent carbon regulations—the EU decided to implement the Carbon Border Adjustment Mechanism (CBAM) (link:https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en). CBAM ensures that imported goods bear a carbon cost similar to EU-produced products.

Screenshot from the EU Official Website: European Union Carbon Border Adjustment Mechanism (CBAM).

2. Key Elements of CBAM

CBAM primarily targets high-carbon-emission industries. Initially, it covers six sectors: steel, aluminum, cement, electricity, fertilizers, and hydrogen. Products from these industries will be subject to additional costs based on their carbon emissions when entering the EU market.

Implementation Timeline:

- October 1, 2023:Transition phase begins—importers must report the carbon emissions of their products but are not yet required to pay a carbon tax.

- 2026:CBAM is fully implemented, and importers must pay carbon costs for their products.

Carbon Tax Calculation:

The carbon emissions of imported products will be priced according to the EU carbon market (ETS). For example, if the EU carbon allowance price is €80 per ton of CO₂, importers must pay carbon tax based on this rate.

How Does CBAM Affect Solar Module Costs?

1. CBAM’s Carbon Pricing Mechanism: How Is Carbon Emission Cost Calculated?

The Carbon Border Adjustment Mechanism (CBAM) aims to impose a carbon tariff on high-carbon-emission imported products to ensure fair competition between EU-based manufacturers and imported goods in terms of carbon costs.

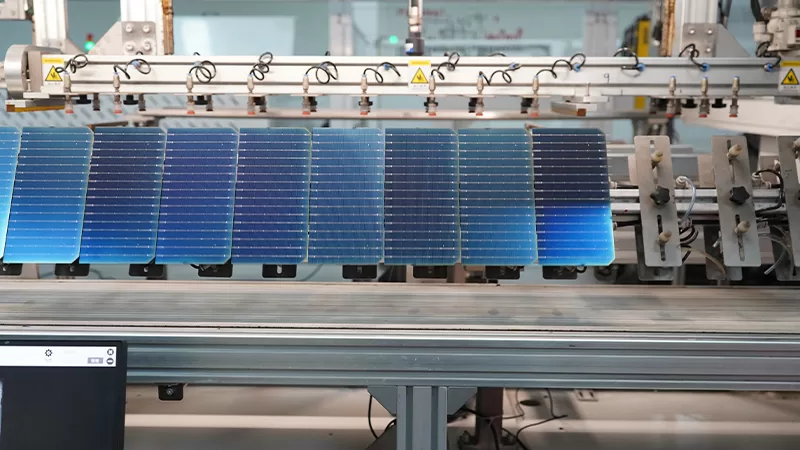

According to documents from the European Commission, CBAM currently applies to high-carbon-emission industries such as steel, cement, aluminum, electricity, fertilizers, and hydrogen. In the future, it may extend to the solar industry, particularly in the production of high-energy-consuming materials such as polysilicon, wafers, solar cells, and modules.

Carbon Pricing Calculation

The cost of carbon under CBAM is calculated based on:

- Carbon Emissions (tCO₂e):The total CO₂ equivalent (CO₂e) emissions produced during the manufacturing process.

- EU Emissions Trading System (EU ETS) Carbon Price:CBAM determines import tax rates based on the EU ETS market price for carbon. For instance, in 2023, EU ETS carbon prices fluctuated between €75-100 per ton of CO₂e.

Calculation Formula:

CBAM Tax=Product Carbon Emissions(tCO2e)×EU ETS Carbon Price(€/tCO2e)

If the exporting country has its own carbon pricing mechanism, companies may deduct previously paid carbon fees, provided they can prove the payments.

2. Carbon Footprint of Mainstream Solar Modules and Differences by Country

The carbon footprint of solar modules primarily depends on the energy sources used in production, manufacturing processes, and supply chain emissions. According to data from the International Energy Agency (IEA) and Fraunhofer ISE, the carbon emission intensity of solar modules varies significantly by country:

Country/Region |

Carbon Emission Intensity (kgCO₂e/kWp) |

Key Factors |

China |

400-550 | High reliance on coal-fired power; high energy consumption in silicon refining and crystal growth. |

Europe (Germany, France, etc.) |

150-250 | Use of low-carbon energy sources such as wind, nuclear, and solar power. |

United States |

250-350 | Primarily dependent on natural gas, resulting in lower emissions than China and Southeast Asia. |

Southeast Asia (Vietnam, Malaysia, etc.) |

300-450 | Mixed reliance on coal and hydropower; carbon footprint depends on supply chain optimization. |

China and Southeast Asia are the primary sources of solar module imports into the EU, making them the most affected by CBAM.

For example, assuming a Chinese-manufactured solar module has a carbon footprint of 500 kgCO₂e/kWp:

500kgCO₂e/kWp=0.5tCO₂e/kWp

If the EU ETS carbon price is €90/tCO₂e, the estimated CBAM tax per kWp would be:

0.5×90=45€/kWp

For a 450W (0.45 kWp) module,the CBAM tax per module would be approximately €20 per panel.

3. Estimated Additional Cost Burden on Solar Modules After CBAM Implementation

Currently, the price of solar modules is approximately €0.15-0.20/Wp (reference only, subject to actual market pricing), equivalent to €150-200/kWp.

With CBAM potentially adding €40-50/kWp in carbon taxes, the import price of solar modules could increase by 20-30%.

Estimated Changes in Supply Chain and Market Structure Due to CBAM

The implementation of the Carbon Border Adjustment Mechanism (CBAM) will significantly impact the global solar module supply chain and market structure, particularly in terms of production, transportation, and market competition. By imposing carbon tariffs on high-emission imported products, CBAM compels the photovoltaic (PV) industry to reassess its supply chain and manufacturing processes. The key anticipated changes are as follows:

1. Supply Chain Restructuring and the Push for Localized Production

CBAM directly drives a restructuring of the PV industry’s supply chain, as the EU market will impose carbon taxes on modules produced in high-emission regions such as China and Southeast Asia, significantly increasing their costs. In response, solar module manufacturers may adopt the following strategies:

- Shifting production to low-emission countries: To reduce CBAM tax burdens, manufacturers from high-emission regions may relocate their production facilitiesto lower-carbon regions, such as Europe, India, or areas with cleaner energy sources.

- Adopting green manufacturing technologies and low-carbon energy sources: Companies may invest more in renewable energy-powered manufacturing plantsto lower carbon emissions. For instance, European PV manufacturers may accelerate the construction of factories powered by wind and solar energy, thereby reducing carbon intensity and minimizing CBAM-related costs.

2. Diversification and Regionalization of Supply Chains

With CBAM coming into effect, the solar module supply chain will evolve towards greater diversification and regional differentiation:

- Adaptation strategies in the Asian market: China and Southeast Asia dominate global solar module production, with China alone accounting for a significant market share. CBAM may drive manufacturers in these regions to restructure their supply chains. To mitigate high carbon tariffs, some companies may relocate production to other Asian countriesor adopt cleaner manufacturing processes.

- Localized production in Europe: The EU may intensify efforts to promote domestic solar module manufacturing, particularly in countries with strong industrial capabilities, such as Germany and France. Establishing more PV manufacturing plants within the EU would enable better control of carbon emissions, helping to avoid CBAM-related costsand enhancing competitiveness in the European market.

3. Changes in Market Competition

CBAM will reshape the global competitive landscape of the solar industry, particularly in terms of production costs and pricing strategies:

- Impact on Chinese manufacturers: Given their higher carbon footprint, Chinese solar module manufacturerswill face higher export costs to the EU due to CBAM taxes. This could weaken their competitiveness in the EU market. To mitigate these effects, Chinese companies may accelerate the adoption of low-carbon production technologies, shift to clean energy sources, or optimize manufacturing processes to reduce emissions.

- Opportunities for European manufacturers: European PV manufacturerswill likely benefit from CBAM. With a lower carbon footprint, EU-based manufacturers will not be subject to CBAM-related tariffs, giving them a cost advantage. Additionally, government incentives and subsidies for low-carbon solar products could further strengthen the position of European manufacturers, allowing them to gain a larger market share.

- Challenges for small and medium-sized PV manufacturers: CBAM may place greater financial pressure on small and medium-sized solar manufacturers, especially those in regions where low-carbon standards are not yet fully implemented. These companies may lack the resources to invest in green manufacturing technologies or adjust their supply chains, making it more challenging to remain competitive.

4. Changes in International Trade Policies

Beyond the solar industry itself, the implementation of CBAM may also trigger shifts in global trade policies related to photovoltaic (PV) products.

- Trade frictions with key partners: CBAM is expected to cause trade tensionswith major exporting countries such as China, India, and Southeast Asian nations. These countries may view CBAM as a trade barrier and could respond with retaliatory tariffs or trade restrictions on EU solar products. As a result, global trade regulations in the PV market may need to be adjusted, particularly concerning supply chain interconnectivity, product pricing, and tariff policies.

5. Driving Technological Innovation and Sustainable Development

Under the pressure of CBAM, solar companies must not only address rising costs but also accelerate technological innovation and industry transformation.

- Advancing green technology innovation: With increasingly strict environmental regulations, PV manufacturers will be compelled to invest more in green technology development. This includes adopting low-energy, low-emission manufacturing processes, improving solar module materials and designs, and enhancing module efficiencyto reduce carbon emissions per unit of energy produced. These innovations will not only help manufacturers mitigate CBAM costs but also contribute to the long-term sustainability of the solar industry.

- Accelerating the green transformation of the global PV sector: CBAM will drive the global PV industry towards greener and more sustainable production models. Major PV manufacturers will be required to allocate more resources to carbon reduction strategies, improve production efficiency, and foster the industry-wide transition to sustainable practices.

Analysis of CBAM’s Impact on the Solar Industry

1. Short-Term Impact

(1) Increased Supply Chain Costs

The implementation of CBAM will directly increase supply chain costs in the solar industry, particularly for key materials such as aluminum frames and solar mounting structures. Major producing countries like China and India, which rely heavily on coal-fired power, have higher carbon emission intensities and will therefore face higher CBAM tariffs. This could lead to a 5–10% increase in solar module costs, affecting the price competitiveness of solar products in the European market.

(2) Changes in EU Market Competition

CBAM may provide an advantage to EU-based solar manufacturers, as they will not be subject to CBAM tariffs. This could allow European companies such as Meyer Burger and REC Solar to expand their market share, while Chinese and Southeast Asian exporters may need to reassess their market strategies.

(3) Higher Transparency Requirements for Carbon Emission Data

As CBAM is implemented, solar companies may be required to disclose carbon emissions data across the entire supply chain, from raw material sourcing to manufacturing and transportation. This will increase compliance costs and necessitate the development of comprehensive carbon tracking systems to meet EU regulatory requirements.

2. Long-Term Impact

(1) Shift of Solar Manufacturing to Europe

As CBAM expands, some leading solar manufacturers are considering establishing production facilities in Europe to reduce carbon tax costs. Companies such as LONGi, JinkoSolar, and Maysun Solar have already begun expanding their European presence, allowing them to better align with market demand and mitigate supply chain risks.

(2) Increased Pressure for a Green Supply Chain

The solar industry is expected to gradually transition towards low-carbon materials, such as low-carbon aluminum and glass, and adopt more energy-efficient manufacturing processes. This shift will not only reduce CBAM-related costs but also align with the global trend toward green economic development.

(3) Adoption of Low-Carbon Solar Modules

In the future, carbon footprint certification may become a market entry requirement for solar products. Solar modules produced with low-carbon manufacturing will be more competitive. Companies should actively invest in low-carbon technologies, such as high-efficiency PERC, HJT, and TOPCon, to reduce carbon emissions per unit of energy generated.

Recommendations for Solar Industry Professionals

For Solar Companies:

- Optimize Supply Chains:

To counter CBAM-related challenges, companies should restructure supply chainsto reduce high-carbon production processes and shift towards low-carbon energy sources. Relocating or adjusting production facilities can help avoid high carbon tax regions and lower operational costs. - Invest in Green Manufacturing:

Increasing investment in green manufacturing technologiescan improve production efficiency and lower carbon emissions. This will not only reduce CBAM burdens but also enhance market competitiveness and support sustainable brand development. - Expand into New Markets:

With CBAMaffecting the EU market, companies should explore low-carbon markets, including developing countries with high demand for green technologies. Given the global focus on sustainability, businesses can also diversify their product lines to meet various market needs. - Drive Technological Innovation:

Investing in R&D to enhance solar module efficiency and develop eco-friendly materials will help lower carbon emissions while maintaining market competitiveness.

For Solar Installers:

- Stay Updated on Policy Changes and Market Trends:

Installers should closely monitor CBAM regulationsand global solar market shifts to adjust business strategies accordingly. Partnering with solar manufacturers can ensure a stable supply chain and mitigate risks from price fluctuations. - Optimize Installation Strategies and Focus on Long-Term Returns:

Given potential price increases, installers can optimize system designsto improve efficiency, helping customers reduce long-term energy costs. Providing diverse product options will allow clients to balance cost and performance - Educate Customers on CBAM and Sustainability Benefits:

Installers should educate customerson CBAM’s impact on solar prices and its environmental significance. By emphasizing long-term benefits, installers can build customer trust and provide transparent pricing in quotations.

For End Consumers:

- Monitor Policies and Incentives:

Consumers should be aware of CBAM-driven price changesand look out for government subsidies that could offset initial investment costs. Many regions offer solar installation incentives that can help reduce upfront expenses. - Focus on Long-Term Benefits:

While CBAM may lead to short-term price increases, solar systems significantly reduce electricity bills, making them a high-return investment in the long run. Consumers should assess solar energy savings over timeto determine investment value. - Choose the Right Solar Products and Installers:

Consumers should opt for low-carbon solar brands that meet green manufacturing standards to ensure sustainable investment. Selecting experienced and certified installers is also crucial for ensuring system quality and performance.

Conclusion

CBAM’s long-term impact on the solar industry is profound. Companies must take proactive measures to mitigate risks while seizing opportunities in the low-carbon transition. As global renewable energy policies evolve, low-carbon solar products will become mainstream, making innovation and competitiveness essential.

In the future, carbon footprint transparency, green supply chains, and European-based manufacturing will be the key success factors for solar businesses.

Since 2008, Maysun Solar has been dedicated to producing high-quality photovoltaic modules. Our range of solar panels, including IBC, HJT and TOPCon panels, and balcony solar stations, are manufactured using advanced technology and offer excellent performance and guaranteed quality. Maysun Solar has successfully established offices and warehouses in many countries and built long-term partnerships with top installers! For the latest quotes on solar panels or any photovoltaic-related inquiries, please contact us. We are committed to serving you, and our products provide reliable assurance.

Recommend Reading:

Solar Module Costs May Rise by 10% in 2026! In-Depth Analysis of CBAM’s Impact on the Industry

Table of Contents Introduction to CBAM 1. Why Did the EU Introduce CBAM? As the challenges posed by global climate change intensify, governments worldwide are accelerating their efforts to achieve carbon neutrality. The European Union, a leader in global carbon reduction initiatives, introduced

New Opportunities for High-Latitude Solar Power in Spring: How to Optimize Generation Efficiency?

This article explores the challenges of springtime solar applications in high-latitude regions and introduces innovative optimization strategies, such as the use of reflective materials, advanced tracking system adjustments, and new module designs, to help solar professionals maximize project returns.

Best Solar Panels: 2025 European Market Procurement Guide

Discover the best solar panels for 2025 in Europe with our concise guide, covering key trends, technology, and product recommendations for smart purchasing decisions.

What’s New in Solar Energy (February 2025)

Discover the rise in European solar panel prices, breakthroughs in solar cell efficiency, new tax exemptions in France for self-consumption projects, the future of grid-scale solar LCOE, and the EU’s legal actions for renewable energy permitting delays.

Why Choose Half-Cell for TOPCon?

Discover the advantages of half-cell technology for TOPCon solar panels, including reduced power losses, better shading tolerance, and improved efficiency.

Wiring Solar Panels in Series vs Parallel: Which Is Better?

Learn the difference between series and parallel wiring for solar panels and discover which configuration is best for your system’s needs and performance.